Introduction to Fidelity and Cryptocurrency Trading

Is Fidelity Safe for Cryptocurrency Trading? Fidelity Investments, established in 1946, is one of the largest and most diversified financial services companies globally. Renowned primarily for its comprehensive offerings in mutual funds, brokerage services, and retirement planning, Fidelity has continually adapted to the evolving financial landscape. This adaptability has been showcased through its entry into the world of digital assets, positioning itself as a serious contender in the growing cryptocurrency market.

The firm took a notable step in 2018 when it launched Fidelity Digital Assets, a subsidiary dedicated to providing institutional clients with access to cryptocurrency trading and custodial services. This move signified not only Fidelity’s commitment to embracing new financial technologies but also its recognition of the increasing demand for digital assets among institutional investors. Fidelity’s extensive experience in traditional investing lends credibility to its foray into the sphere of cryptocurrency, facilitating a more secure and regulated environment for trading digital currencies.

Fidelity’s approach to cryptocurrency trading reflects a strong commitment to security and regulatory compliance. The company acknowledges the inherent risks associated with digital assets and emphasizes its role in protecting clients’ investments. By implementing advanced security measures and educating clients about the cryptocurrency market, Fidelity aims to mitigate risks, thereby instilling confidence among users who may be apprehensive about engaging with cryptocurrencies. Consequently, the company has established itself as a reputable player, positioning Fidelity crypto trading as a viable option for both seasoned investors and newcomers alike.

Overall, through its transition into the digital asset space, Fidelity has not only broadened its offerings but also contributed significantly to the legitimization of cryptocurrency trading within the broader financial system. This evolution highlights Fidelity’s role as a pivotal entity in the cryptocurrency trading landscape, catering to the needs of a diverse range of investors.

Understanding Cryptocurrency Trading Risks

Cryptocurrency trading presents unique advantages, as well as significant inherent risks that traders must navigate. One of the most prominent concerns is market volatility. The cryptocurrency market is known for its rapid price fluctuations; substantial gains can often be matched by equally steep losses within very short timeframes. This volatility can be exacerbated by external factors, including market sentiment, regulatory changes, and macroeconomic trends, making it crucial for traders to remain informed and cautious.

Security concerns also loom large in the cryptocurrency trading landscape. Many traders fear the potential for hacking and fraud, as digital assets can be particularly susceptible to cybercrime. While platforms like Fidelity implement robust security measures, including advanced encryption technologies and account protections, no system can claim to be entirely impervious to risks. Thus, traders must recognize the importance of safeguarding their investments through due diligence and the use of secure practices.

Regulatory challenges add another layer of complexity to cryptocurrency trading. As governments and financial authorities worldwide grapple with the implications of digital currencies, regulations can shift dramatically. Traders face the risk of sudden legal restrictions that could impact their trading activities, further complicating decision-making. Additionally, liquidity issues may arise, particularly for less popular cryptocurrencies, where the ability to buy or sell assets without causing significant price changes can be limited. Understanding these factors is vital in assessing the overall risk profile associated with trading crypto assets.

In conclusion, evaluating the risks of cryptocurrency trading, such as market volatility, security concerns, regulatory challenges, and liquidity issues, serves as a crucial first step in determining the safety of trading platforms, including Fidelity. By grasping these inherent risks, traders can establish better strategies to protect their investments and navigate the complex world of cryptocurrency trading more effectively.

Fidelity’s Security Measures for Cryptocurrency Trading

Fidelity Investments has emerged as a significant player in the cryptocurrency trading landscape, catering to a diverse range of investors. A critical aspect that sets the institution apart is its robust security measures designed to protect users’ investments in cryptocurrencies. Understanding these security protocols is vital for those considering engaging with Fidelity crypto platforms.

One of the key pillars of Fidelity’s security infrastructure is encryption. The firm employs advanced encryption technologies to safeguard users’ data and digital assets during the trading process. This encryption ensures that sensitive information, such as account details and transaction histories, is transmitted securely, minimizing the risk of interception by unauthorized entities.

Another crucial element in Fidelity’s security strategy is the utilization of cold storage. A significant portion of client cryptocurrency assets is stored offline, which dramatically reduces the vulnerability to hacking attempts. Cold storage acts as a protective barrier, ensuring that cryptocurrencies are kept in environments that are not connected to the internet, making them less susceptible to cyber threats.

To further strengthen security, Fidelity employs two-factor authentication (2FA) for user accounts. This additional layer of protection requires users to provide two forms of identification before accessing their accounts, thus enhancing the overall integrity of the platform. The implementation of 2FA significantly deters unauthorized access, adding peace of mind for investors who might be wary about cybersecurity risks associated with cryptocurrency trading.

Lastly, Fidelity has instituted comprehensive insurance policies for its digital asset holdings. These policies provide a level of assurance for clients, as they cover potential losses due to theft or fraud. This coverage elevates Fidelity’s commitment to safeguarding investments in loyalty to its long-standing reputation in the financial sector, enhancing the trustworthiness of its crypto offerings.

Regulatory Compliance and Legal Framework

Fidelity Investments has established itself as a reputable player in the cryptocurrency trading landscape, largely due to its commitment to adhering to regulatory compliance and the legal frameworks that govern this evolving market. Cryptocurrency trading is subject to a myriad of regulations that vary widely by jurisdiction, and Fidelity has consistently prioritized its alignment with these standards to foster trust and security among its users.

In the United States, cryptocurrency trading activities are primarily regulated by the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). Fidelity proactively engages with these regulatory bodies to ensure its crypto services comply with existing laws and reflect the latest regulatory developments. This proactive approach includes implementing Anti-Money Laundering (AML) policies and Know Your Customer (KYC) procedures as required under the Bank Secrecy Act (BSA). By doing so, Fidelity aims to mitigate risks associated with cryptocurrency trading while ensuring a transparent operational framework.

Internationally, Fidelity also navigates the legal frameworks established by entities such as the European Securities and Markets Authority (ESMA) and various financial regulatory authorities across Asia and Australia. These jurisdictions often have unique compliance requirements varying from strict licensing processes to stringent consumer protection regulations. Fidelity’s global footprint illustrates its capability to adapt its operational practices to accommodate international standards, ensuring it remains compliant with the diverse regulatory expectations governing cryptocurrency trading in multiple territories.

Furthermore, with the continuous evolution of crypto regulations, Fidelity highlights its commitment to staying at the forefront of regulatory changes. This adaptability is crucial for ensuring that its offerings in the fidelity crypto space remain both compliant and secure for investors, ultimately promoting user confidence in its trading platform. Fidelity’s robust compliance framework not only reflects its commitment to legal standards but also contributes to the establishment of a safer cryptocurrency trading environment for all participants.

User Experience and Interface Overview

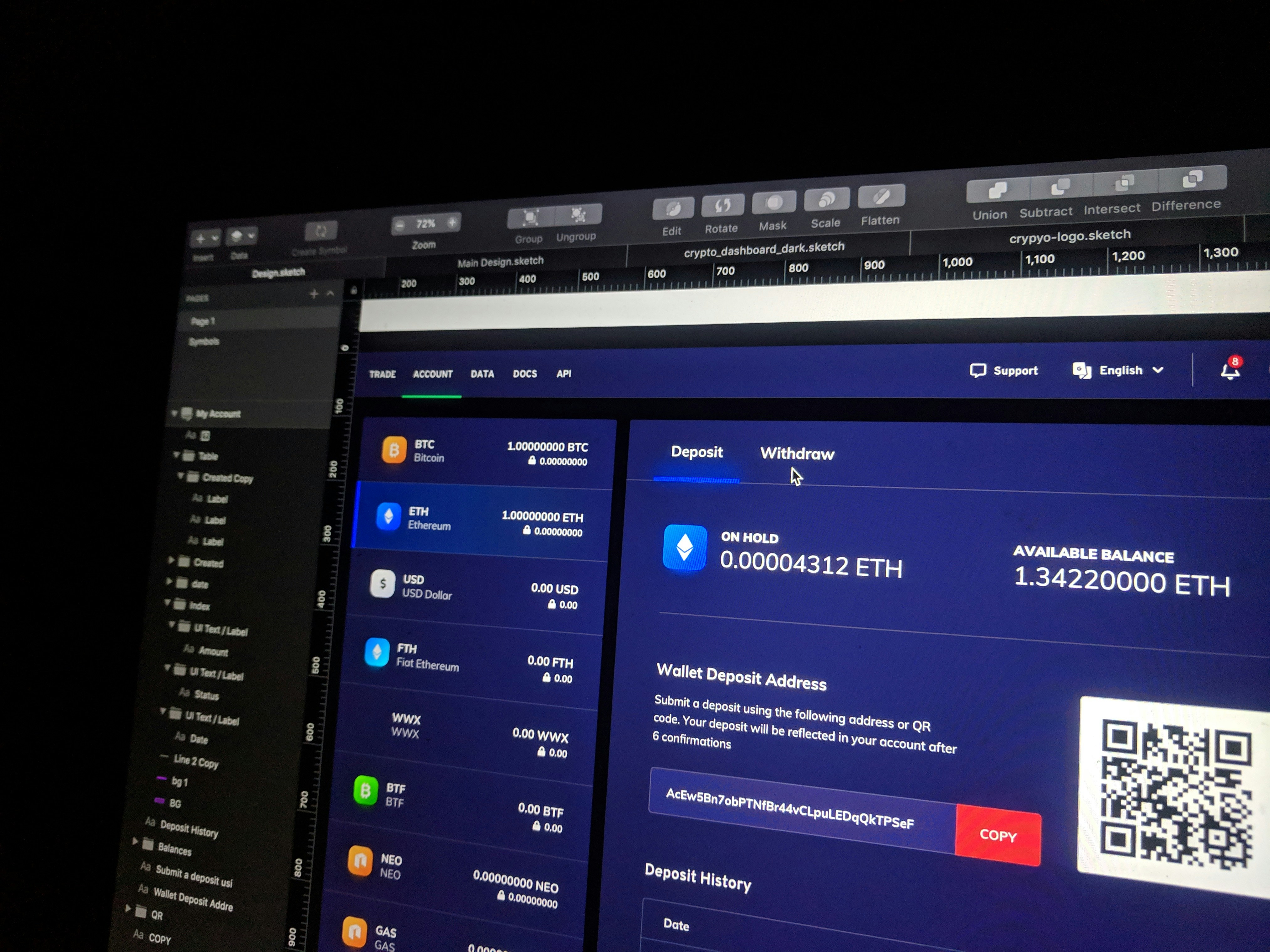

Fidelity has developed a platform that is designed not only to appeal to seasoned cryptocurrency traders but also to accommodate novice users. The interface is characterized by its clean layout, intuitive navigation, and user-friendly design, which collectively enhance the overall trading experience. Upon logging in, users are greeted with a customizable dashboard that provides a comprehensive overview of their portfolio alongside essential market data. This level of flexibility is particularly beneficial for traders looking to streamline their trading process.

One of the standout features of Fidelity’s interface is its extensive educational resources, which serve to inform users about the intricacies of cryptocurrency trading. These resources include articles, video tutorials, and webinars that help demystify cryptocurrency concepts, making the platform more accessible to those who are new to trading. The focus on education reflects Fidelity’s commitment to fostering an informed trading environment, which is crucial given the complexities of the crypto market.

In addition to its educational offerings, Fidelity’s platform includes advanced trading tools that appeal to experienced investors. Features such as real-time market analysis, charting tools, and order types allow traders to execute strategies effectively and manage their investments smartly. The integration of alerts and notifications means that users are kept informed of market movements relevant to their portfolios, enabling timely decision-making.

Moreover, the mobile application maintains the same functionality as the desktop version, allowing users to trade on the go. This flexibility is increasingly important in today’s fast-paced market. Overall, Fidelity has prioritized user experience, ensuring that its platform caters to the diverse needs of cryptocurrency traders, making it a compelling option in the competitive landscape of digital asset trading.

Customer Support and Educational Resources

Fidelity’s approach to customer support for cryptocurrency trading is multidimensional, aimed at enhancing user experience and ensuring that clients have access to essential resources. The company’s dedicated support teams are available to assist traders through various channels, such as phone support, live chat, and email. This availability allows cryptocurrency traders to seek assistance promptly, addressing inquiries or issues they may face while navigating the platform. Fidelity has made it a priority to maintain a knowledgeable support staff well-versed in both the intricacies of cryptocurrency trading and the functionalities of their platform.

Additionally, Fidelity provides a comprehensive suite of educational resources to support its clients. For new and experienced traders alike, the company offers a wealth of materials designed to foster a deeper understanding of cryptocurrency markets. Users can find a range of tutorials, articles, and guides on topics such as market trends, trading strategies, and asset management. By breaking down complex concepts into digestible content, Fidelity aims to empower its users with the knowledge they need to make informed decisions regarding their investments.

Moreover, Fidelity often hosts webinars that cover various aspects of cryptocurrency trading. These interactive sessions allow participants to learn directly from experts and engage with community members who share similar interests. Community forums also serve as an invaluable resource, as traders can exchange ideas, strategies, and insights with one another, thereby enhancing their trading experience. Overall, Fidelity’s commitment to providing robust customer support and diverse educational opportunities emphasizes its dedication to creating a positive environment for cryptocurrency trading, aligning with the principles of user-centric service.

Comparative Analysis with Other Cryptocurrency Platforms

The cryptocurrency trading landscape is diverse, with numerous platforms catering to varying needs and preferences. Fidelity Crypto distinguishes itself in several areas, but a thorough comparative analysis reveals both its strengths and weaknesses when measured against major competitors such as Coinbase, Binance, and Kraken.

When it comes to fees, Fidelity Crypto operates on a more straightforward pricing model. The absence of commission fees on trades is a significant advantage, contrasting with platforms like Coinbase, which charge variable fees that can accumulate quickly for frequent traders. However, users should be aware of potential spreads which can affect overall trading costs. In comparison, Binance offers a tiered fee structure that can yield lower costs for high-volume traders but may be less appealing for newcomers who make fewer trades.

Security is a critical factor in evaluating cryptocurrency trading platforms. Fidelity has a long-standing reputation for robust security protocols, bolstered by its expertise in financial services. The platform includes features such as two-factor authentication and cold storage options, rivaling the best security measures on other platforms. For instance, Kraken also emphasizes security, obtaining a reputation for its regulatory compliance and robust security features. Nonetheless, incidents of hacking have occurred on various platforms, highlighting the importance of choosing a provider with a strong security track record.

In terms of trading options, Fidelity Crypto provides various cryptocurrencies, but it may not offer the breadth seen on exchanges like Binance, which supports a vast array of altcoins. This limitation could affect traders seeking exposure to niche or emerging cryptocurrencies. Additionally, customer service varies across platforms; Fidelity is known for its comprehensive support, which may provide an edge over competitors like Binance, where users occasionally report difficulties in receiving timely assistance.

Ultimately, while Fidelity Crypto offers clear advantages in terms of security and fee structure, evaluating its trading options and customer service in constructing a well-rounded cryptocurrency trading experience is essential. A detailed examination of these factors allows users to assess Fidelity’s position relative to other platforms in an ever-evolving market, ultimately guiding them to make informed choices in their trading endeavors.

User Testimonials and Case Studies

The growth of cryptocurrency trading has led many investors to explore various platforms, with Fidelity being one of the prominent names in the industry. User testimonials and case studies provide valuable insights into the experiences of traders who have utilized Fidelity for their cryptocurrency transactions. Numerous users have reported a positive and secure trading environment, which has contributed to a growing sense of trust and reliability.

One notable testimonial comes from an experienced trader who valued Fidelity’s robust security measures for managing digital assets. This user highlighted the platform’s emphasis on protecting clients’ funds, which included advanced encryption protocols and multi-factor authentication. Such features are crucial for traders concerned about the safety of their investments in an unregulated market like cryptocurrency. The trader noted that through consistent performance and responsive customer support, their confidence in Fidelity crypto trading grew significantly.

Another case study showcases a novice trader who transitioned to cryptocurrency investing through Fidelity. Initially hesitant due to concerns about the complexities of the crypto landscape, this trader praised Fidelity for its user-friendly interface and comprehensive educational resources. They reported that the platform made it easier to understand market trends and execute trades efficiently. This user’s journey reflects a broader trend of satisfied beginners who appreciate Fidelity’s commitment to guiding new customers through the sometimes daunting world of cryptocurrency trading.

Further anecdotal evidence points to a diverse range of investors benefiting from Fidelity’s cryptocurrency offerings. Some testimonials highlight successful long-term investments, while others emphasize the user-friendly tools that aid in informed trading strategies. Together, these user experiences underline the reliability and satisfaction associated with trading on Fidelity, making it an appealing option for prospective cryptocurrency traders considering their options in this fast-evolving market.

Conclusion: Is Fidelity Safe for Cryptocurrency Trading?

As we have explored throughout this blog post, the safety of Fidelity as a cryptocurrency trading platform is a multifaceted topic that warrants careful consideration. Fidelity has earned a robust reputation in the financial services industry, known for its regulatory compliance and security measures. The platform employs advanced cybersecurity protocols, including two-factor authentication and encryption, to mitigate risks associated with trading digital assets like cryptocurrencies. These features contribute significantly to the overall safety of Fidelity crypto trading.

Moreover, Fidelity’s long-standing track record in traditional financial markets adds an additional layer of trust and credibility. The firm operates under strict regulatory frameworks, adhering to the standards set by governing bodies. This commitment to regulation further enhances the reliability of Fidelity as a platform for those engaging in cryptocurrency trading.

However, prospective users should also be aware of the inherent risks associated with trading cryptocurrencies themselves. The volatility of the crypto market can lead to substantial financial fluctuations, independent of the platform’s safety measures. Therefore, investors need to practice due diligence and risk management while trading. The possibility of loss is a crucial factor to consider, regardless of how secure a trading platform may be.

In summary, Fidelity presents a solid option for individuals seeking a secure environment to engage in cryptocurrency trading. With its strong security protocols, regulatory compliance, and reputable background, it stands out as a reliable choice. However, it is essential for users to weigh these advantages against the risks associated with cryptocurrencies. Ultimately, individuals must make informed decisions based on their risk tolerance and investment goals before diving into the world of Fidelity crypto trading.