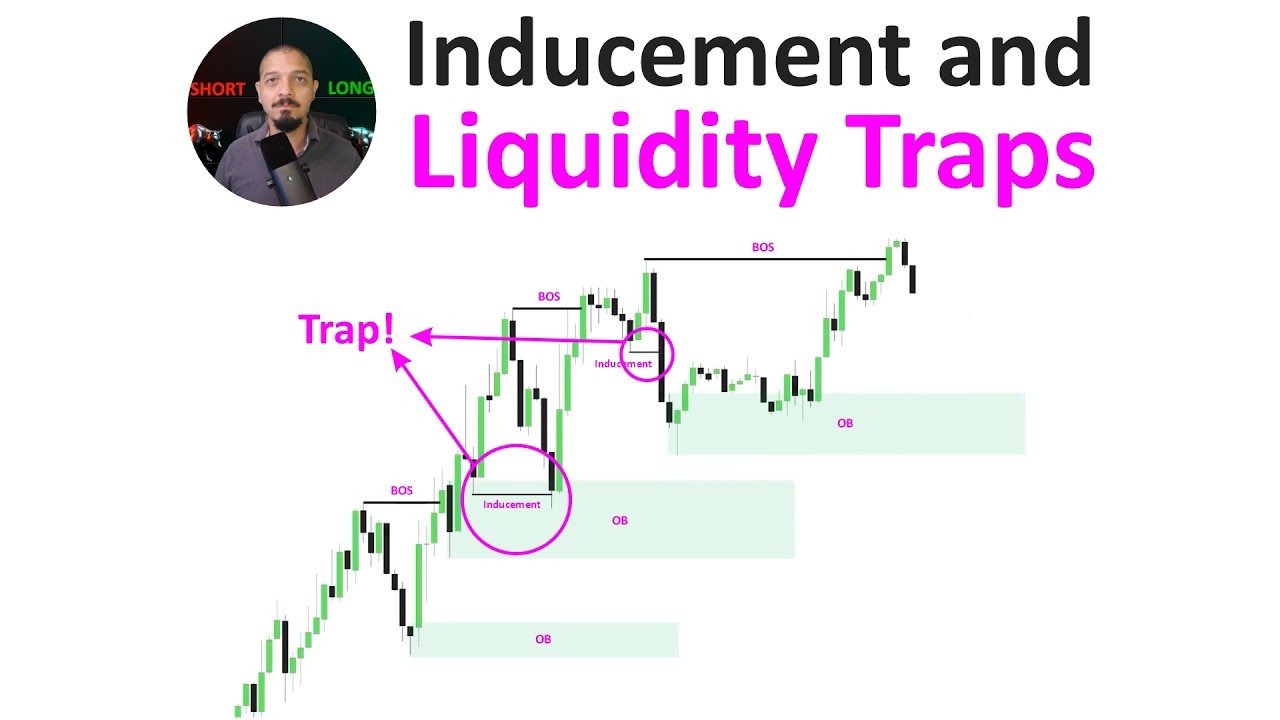

Smart money does not chase price. It creates traps, builds liquidity, and then delivers the real move.

In this masterclass, we break down inducement and liquidity traps step by step, showing how smart money engineers fake breakouts, false changes of character, misleading pullbacks, and clean looking order blocks that exist only to trap traders.

You will learn how inducement forms inside market structure, why shallow retracements create liquidity hunts, and how to align higher and lower time frames to avoid entering too early. We cover structural inducement, liquidity based inducement, and time based inducement with real chart examples so you can recognize these patterns in live markets.

This video will help you stop trading where retail gets trapped and start executing where institutions actually enter. If you want cleaner entries, higher probability setups, and better risk to reward, this lesson is essential.

#smartmoneyconcepts #marketstructure #inducement #liquiditytraps #forextrading #tradingeducation #professionaltrader

🎁 Support ComLucro Trader for free, high-quality trading content. Get early access to exclusive videos and posts!

Become a member and get benefits: https://www.youtube.com/channel/UC4nw0IYkthSqNeaYzOzxvTw/join

📊 Recommended Broker for Traders:

Trade with Exness and access fast execution, competitive spreads, and trusted regulation.

👉 Open your account here: https://one.exnessonelink.com/a/c_ewofuxuqbq

📈 Best Charting Platform for Analysis:

Use TradingView to track markets with professional tools, advanced charts, and real-time data.

👉 Try it here: https://www.tradingview.com/?aff_id=119375

🌐 Com Lucro – https://www.comlucro.com.br/

📺 YouTube – Com Lucro – https://comlucro.com.br/youtube

source

@comlucrotrader

Most traders lose not because their bias is wrong, but because they enter inside inducement.

Which type of inducement traps you the most: structural, liquidity based, or time based? 👇

@davidibiyemi1308

Thanks Sir

@abdulkabeerabdulwahab982

Thank you for your good works. Please can you take time to explain the concept of mitigation with respect to timeframes

@bhushanrai4696

Well explained Thank you Sir

@TravisCarey-b1j

Very Good explanation

@LessGooFX

Ai?

@charleskirimuttu3365

Thanks alot for the lessons. They have shifted my thinking into a careful beginning trader. Kindly talk about swing trading where entry is H1 or H4. Thanks and a happy cum lucro year of fruits.

@mohmadasif7294

Superb

@danielhoward4566

Focus on making money trading vs making videos okay?

@TylerVivanco

Is this guy AI?

@luci66613

Basically Sam seiden supply and demand strategy

@feውyosief8509

Could you please create content about a line chart, including wicks?

🤜🤛

@khanyosontange4634

🤔 .. like stop hunts?