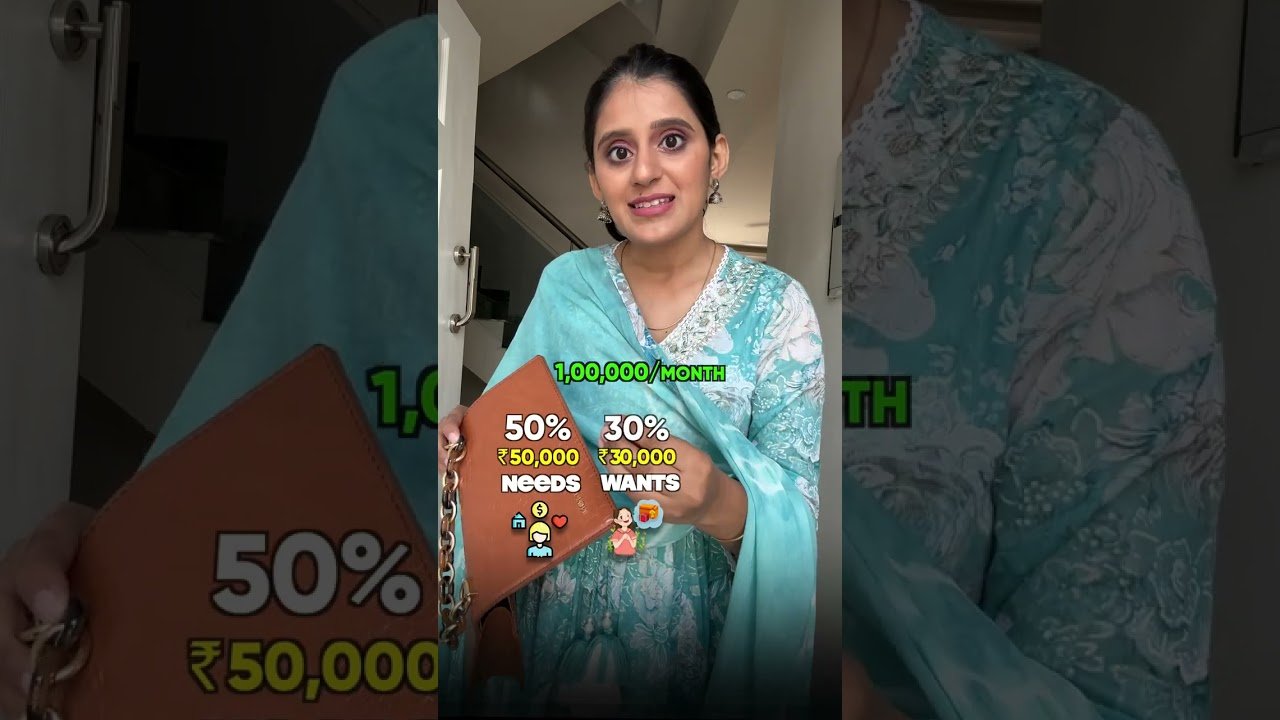

Don’t follow the 50/30/20 rule blindly!

The 50/30/20 rule is a great starting point for managing your finances and achieving financial stability.

It provides a simple framework for dividing your income into three categories: needs, wants, and savings.

However, it’s important to recognize that this rule is not set in stone, and your financial situation may change over time.

As you earn more money, you may notice that the things you need to buy become a smaller part of your total expenses.

This means you might have more money left over to spend on things you want.

This is called “lifestyle inflation” but you should ideally need to set a limit on your needs and increase the percentage you allocate to wants and savings.

For example, you can increase your contributions to retirement accounts, emergency savings, or other long-term investments.

Remember that your financial situation is unique, and there is no one-size-fits-all solution for managing your money.

Take the time to assess your needs, wants, and goals regularly and adjust your budget accordingly.

With discipline, focus, and a willingness to adapt, you can achieve financial freedom and live the life you deserve.

Let me know what are your thought on it

#nehanagar #finance #personalfinance #budgeting

source

@SaveLikePro

Yes!! Make sense!!

@ayushtewari2826

50-30-20 is for foreigners, where they don't have to think about very high college prices and heavy budget weddings.

Think of, money saved = money earned.

Then it'll become rewarding each time you don't spend on useless things.

@the_ackerman_

That's a common sense you dump 😂

@sajanyadav368

Ye rules low income walo ke liye sahi hai . Jinki salary kam aur expans jyada hai

@debdattanag136

Finaly someone talking the truth i also follow save as much as i can and limit my needs

@AmrutaWagh-kb3yv

she is thinking same as me thank you

@vrajprajapati3645

You should use 50 – 30 – 20 rule only if you have no tax

@Shortsnips1

Aankh hai ya tamatar

@debtanaydeasi

Baklol 1lakh se 10lakh?

@GURUTUNE

Income badhne ki baad 50 30 20 ko 50 20 30 kar dena chahiye

@Dave_en

Needs pe spending fixed nhi hota. Inflation count karna hi padta hai. 50 30 20 rule bhi humesha kaam nhi karta. Issliye ya toh budgeting seekhiye ya phir professional se consult kijiye.

Big cities me low salary hogi toh 70% needs me kharch ho jayega, 20% wants me aur 10% savings aur investments me. Aur aapko pata bhi nhi chalega kab aapka 50 30 20 rule ulta pad jayega.😂😂😂

@MutualfundsahiHainbutkaunsa

Al din mar gaye toh tum kya karoge

@brajeshrajanand

Sahi baat hai

@PolKhol-m3e

Only Possible with women. Not with men .

@tusharjaiswal1463

Most sensible video, main bhi yahi soch raha tha kuch din pehle

@chacha-ph6qg

Well said❤

@genzsoothe

🤡you don't have even basic knowledge this rule is useful only if you have very little income like about 20 or 25k not for people earning 1lpm or 1cr per month🧠

@MUHAMMAD.HANZALAHAHMAD

Or pessa jmma krty krty mar jayen

@naman881

Mine is 30 70

@nishchintalniche9372

Good

@suhanaguru6491

But agar hamne loan liya hi nahi hai tho hum debt me kasie padenge explain and baki hamne thoda save and invest tho kar hi rakha hai na

@gauravi_deo

I thought 50 is for investment, 30 for needs and 20 for other things 😊

@mohamedrizwan8338

10 lakhs per month ah 🤯🤯 that too after 5 yrs 😮😮

@harsh4986

Where is tax ??

@harsh4986

Where is income tax?

@RoraKaur

❤

@mradulrajpoot5935

Practically not possible for family person only for individuals….. inflation ko kya fix kiya ja sakta hai…. mehengai to badhegi hi

@SahinMalik-n4e

18000 walo ko 50.20. 30 . Wala ki follow karn chiyaa

@niteeshrai8294

Using husband money😂😂

@Vivekparyekar

Salary kuch jyada hi hai

Video dekh kar jalan hoti