MIT 18.S096 Topics in Mathematics with Applications in Finance, Fall 2013

View the complete course: http://ocw.mit.edu/18-S096F13

Instructor: Jake Xia

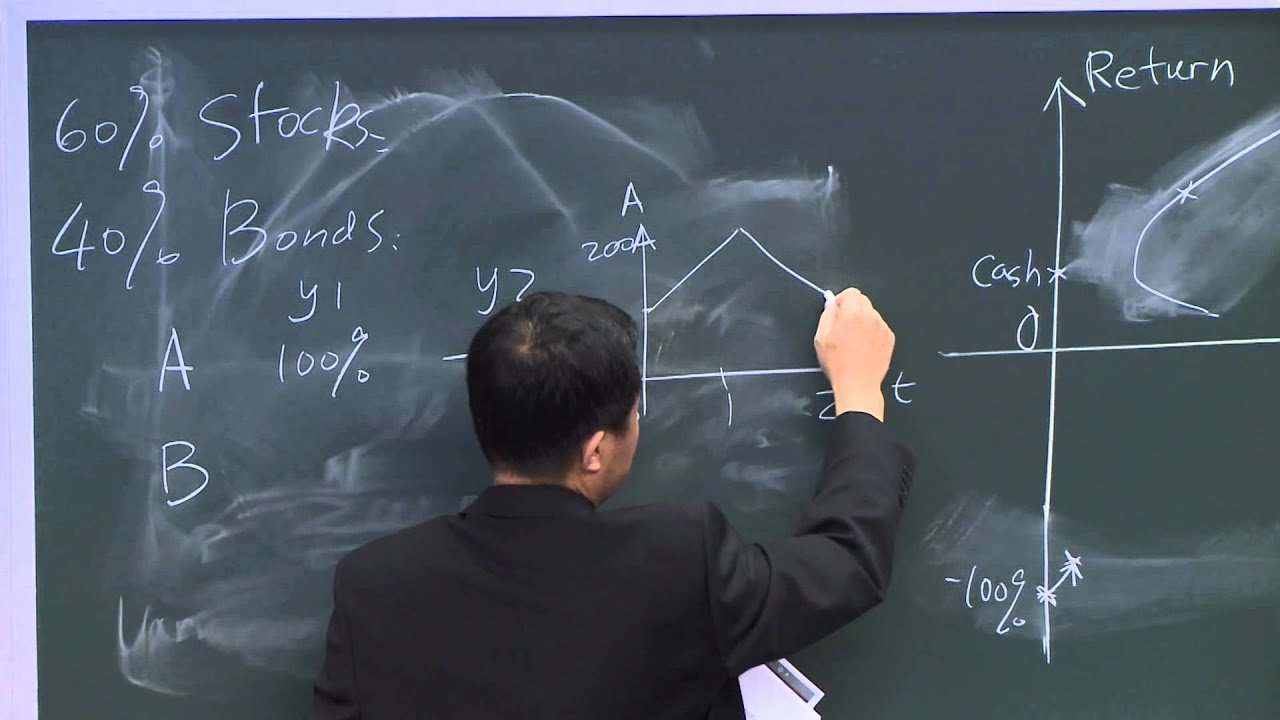

This lecture focuses on portfolio management, including portfolio construction, portfolio theory, risk parity portfolios, and their limitations.

License: Creative Commons BY-NC-SA

More information at http://ocw.mit.edu/terms

More courses at http://ocw.mit.edu

source

@nwdhr3468

2025 here

@Kuro1119-m5v

simply but on point lecture and explanation I would like to read his written finance textbook

@miraclepik

Me in 2025

@evanfernandes485

Bro is totaly wrong what he said about physics

@arnontillmann

Could I use this for other types of portfolios? Not only in pure Financial assets, but for any products portfolio.

@lisaprince1313

this is a serious individual conducting this lecture

@alejandropoirier6493

Who came here from instagram?

@elliot_waves3385

Anyone in 2025

@jonathanmartinez7557

I don't understand but we here

@mujeebaly

20:19

@Tomteluva82

very informative!

@abdul_kobi

This guy is a financial genius

@maystephens1716

Best free education ever, thanks MIT!

@iamheenakohli

amazing course

@JerickChen-d4

Thanks for your reply 👍

@PaidYT2025

The risk rewards graph seems incorrect!

@ssj9863

😊

@sgrmul6176

How would lottery have SD close to 0?

@josefyuri171

Overall, 51% of traders think this year would favor stocks, mutual funds, and other equity-based investments, despite Treasury yields and other safer cash-like investments paying big. I’m looking for opportunities in the market that could fetch me $1m ahead of retirement by 2026

@garbeleung5237

Why is the standard deviation of the lottery shown as being close to zero? Shouldn’t it actually be extremely high?

@BRichard312

This approach to investing quite frankly, in my opinion, is somewhat dated. As a Data Scientist, the goal of portfolio management has nothing to do with expected returns or what you will be making in 5 years or 10 years time. I'm not sure in a NON-LINEAR system like the stock market is why that would be pursued. You are not going to get it right – EVER. I don't think you will even be close in terms of prediction.

In the NEW way of investing, post 2022, the objective of portfolio management is to increase the portfolio's market value relative to the returns. That's it. Now, how you do that takes a lot of portfolio knowledge but that, to me is the grand objective of all market investing. If you focus too much on returns, you will lose market value and vice versa. This is where the art of investing is truly realized, because it is the most difficult aspect of investing to get right.

No one cares about what you think you will make in a year or 5 years. It's all an estimate at best. You can calculate that but I'm not sure what the value proposition is for doing that. Start with 1M and a brokerage account and you can expect to make about 7-10% a month on that money if you know what you are doing. That's the extent of estimating.

@Miguel1-j9y

❤

@magellanjimenez8238

Here in 2025

@samuelfebriannababan9147

anyone in 2025???

@SB-md2km

He spelled commodities wrong…

@TeaWithBud

It's crazy that gold would be listed like that as just another commodity.

It performed very differently over the last four years.

It's now on its way to being remonetized at the international settlement level.

Also, it's fucking gold.

@austinb3560

Bro said very simple math 😂

@daniil-v3h

Лв опять напился

@mohammadrahmaty521

no BTC at that time 🙂

@АзаматШарипов-м2ч

Isn’t standard deviation of coin flip 50%?

@crux.earwig

Anyone in 2026 ???