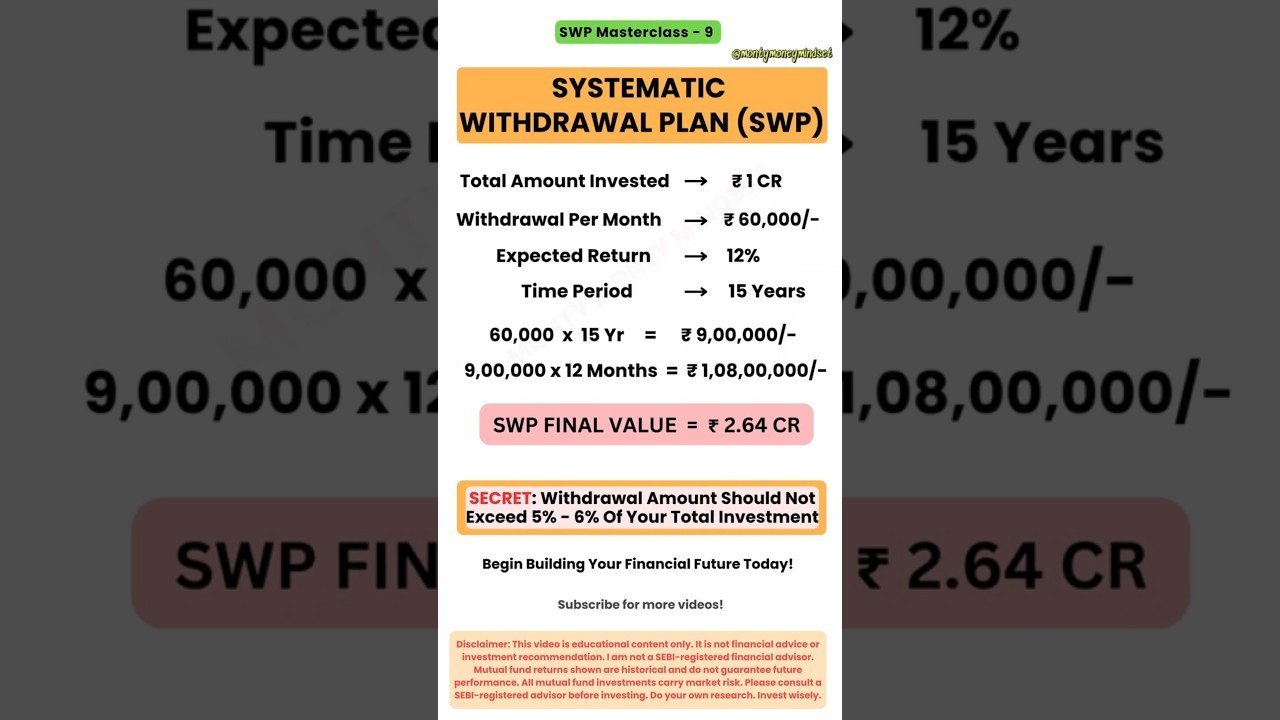

In this short, you’ll understand how a Systematic Withdrawal Plan (SWP) works using a simple illustration with a ₹1 crore lump‑sum investment, a monthly withdrawal of ₹60,000, 12% expected annual return and a 15‑year time period (for illustration only, not guaranteed).

SWP can help investors create a regular monthly cash flow from mutual funds while allowing the remaining corpus to stay invested and potentially grow, as long as the withdrawal rate is kept within a reasonable band such as 4–6% per year so that the money lasts longer in retirement.

What you’ll see in this video:

What an SWP is and how it differs from a SIP.

Example: ₹1 crore invested, ₹60,000 monthly withdrawals, 15‑year horizon and final value illustration.

Why many planners suggest keeping annual withdrawals to about 4–6% of the total investment to reduce the risk of depleting your corpus too early.

Comment below if you plan to use an SWP for retirement income.

Like, share and subscribe for more shorts on SWP, SIP, mutual funds, ETFs and retirement planning.

https://www.youtube.com/@MontyMoneyMindset

Subscribe to @montymoneymindset for more videos!

#wealthcreation #swpmutualfund #retirementplanning #financialfreedom #mutualfundsindia #passiveincome #monthlyincome #sipvswp #personalfinance #investsmart #wealthbuilding #mutualfundeducation

Disclaimer:

The views and information shared in this video are for educational and informational purposes only and do not constitute financial advice. I am not a SEBI-registered financial advisor. Please consult a qualified professional before making any investment decisions. Investments in mutual funds and financial markets are subject to risks. Past performance does not guarantee future results.

Search Items:-

systematic withdrawal plan, SWP mutual fund India, passive income India, SWP returns, monthly withdrawal strategy, best mutual funds for SWP, retirement income plan, income from mutual funds, Indian wealth creation, SWP vs SIP, cash flow investing, SWP masterclass, investment hacks, Monty Money Mindset, tax saving strategy, regular income from investment, financial planning India, how to set up swp, mutual fund monthly income plan, retirement planning india, passive income from mutual funds, mutual fund taxation swp, financial freedom india

mutual funds,

investment for beginners,

best mutual fund to invest now,

best stocks to invest in 2025,

fd vs sip,

1 lakh investment plan,

sip lumpsum amount return,

nifty 50,

nippon india small cap fund,

best sip 2025,

sip investment in hindi,

best stocks to buy now,

investment ideas,

best daily sip in mutual fund,

sip,

micro cap mutual funds,

mutual fund investment,

financial freedom,

step up sip,

swp for monthly income,

home loan vs sip,

home loan vs sip investment,

silver investment,

gold investment,

sip investment kaise kre,

startup ideas,

best business ideas 2025,

trading for beginners,

mutual fund portfolio,

sip withdrawal process,

swp,

best xirr in mutual fund,

high return mutual funds,

sip se paise kaise nikale,

trading kitne paise se start kr skte hai,

motilal oswal midcap fund,

sip calculator,

sip vs lumpsum which is better,

money plan,

source

@Savitha2014

60k per month or

Per year.

60k×12m=720000₹ × 15year's

@AnkushSantra-swash

I earn some chill cash with Brave Browser and Swash App. No need to invest anything, and it’s super easy to set up. Plus, I knock out tasks on Swash Earn when I'm just hanging around, which helps me pay my bills without stress.

@maheshchikkamath7908

Lekka kaliyo thamma

@VejendlaJyoti

Wrong information