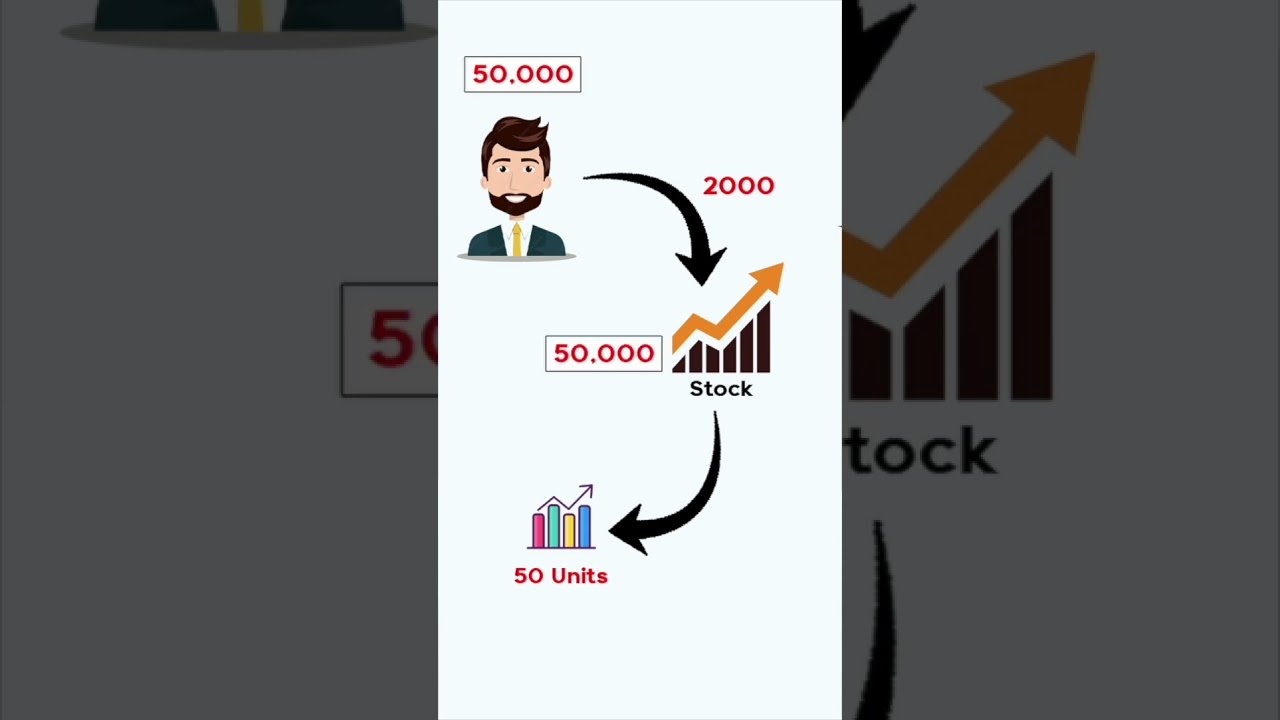

Many new investors often face a common dilemma: they purchased stocks that have appreciated in value, and now they want to leave their profits untouched while withdrawing only their initial investment. The question arises: should they be liable to pay taxes in this scenario?

Book 1-1 video call : https://topmate.io/finance_boosan

Instagram : https://www.instagram.com/finance.boosan/

Join Learner’s Community : https://www.youtube.com/channel/UCmfl6VteCu880D8Txl4vEag/join

Other useful links : https://beacons.ai/boosan

_______________________________________________

_______________________________________________

#financeBoosan #usefulinformationBoosan

Stock Market, Mutual Funds, Investments, Personal Finance,

source

@MANIKANDAN-tf7qf

Bro namba Grow app la sell pannum podhu market price ah vida kammiya sell aguthu athu yen?

@SekarVinito

Sir phone number send

@904081

Do we need to pay tax if annual income is zero ?

@MeSaravana

Bro, for such short term gain irrespective of amount should we file ITR and pay tax or considering tax slab if it’s lesser need not pay tax ?

@Its_c-sharp_developer

Sip and stock return na edukum pothu elvo actually enoda hand varum yellarum 1 crore 2 crore solringa real example oda oru video podunga

@thiruvadie752

In this case there is no tax for 50k after 1 yr correct ?

@Rajtamizhan

Good explanation but I am confused that

For example if I got 1 lot of IPO shares for Rs 15000 and

After selling the shares for 30000 on the listing day means some amount( initial + profit) will be credited to our DP after some charges like brokerage, STT, DP, etc(mentioned in contract note)

The above I know but the amount reflected on my DP account is after deducting the STCG tax(20%) or the full amount will be credited.

If full amount credited, how the government collect STCG taxes ? 😕

@karthiksaadithya

Ponga na. Tax ellam ethitaanga

@sathishd9627

I sold and buy new stock means no tax for current year

@rkodeepak98

Anna, I'm new to this.. don't know about trading, sip, swp, and how to invest,. response

@இரத்தம்

Puriyala

@Hasansindustry

Appo 5 yrs la panna last 4 yrs ku tax illaya? Brother?

@arun_tn_55

hi

@ramakrishnan4716

😂 Government mind voice : Yenna Enna

Elicha Vayanu ninachiya 😂😂😂

@sethuramansethuraman3980

Bro Bond pathi video poduga bro

@MR-bi6fw

Kana pinanu tax iruku.m**u country evlo tax

@razor-cut

2,3 years ah try pandren 1L innum varala bro 😅 overall profit eh 1.5k la iruku 😂 what to do

@mynameisvj

I have a share 200 shares out of that how do we know which one is one year old? @finance.boosan

@82chandar

brother i have a doubt, for ex: i invest Rs.1000/- in SIP for last 5 years and now i withdraw Rs.10000/- whether the units will be sold from 1st year and tax will be calculated under long term capital or the units will be sold from last year and tax will be calculated for short term capital?

@BoopathiBoopa-t8n

Bro eppdi bro etf gold selling tax kattanum

@kamatchivnp7973

Bro nega yanha sip la investment pani erukinga

@satheesharilius4209

Good afternoon sir

@Raja-nz9yz

Anna epdi start panrathu

@yuvaraj1857

Brother I'm beginner how to buy good profit company stocks. How to know.

@monishkat3249

உங்க கிட்ட பேச என்ன பண்ணனும்

@vijaiantony7170

NRI account la erunthu india la invest pannuna ITR file pannanuma bro

@Kannan-l1l1d

Tax kattanuma illa automatically pidipangala

@Yogi-xp9ye

Super broo