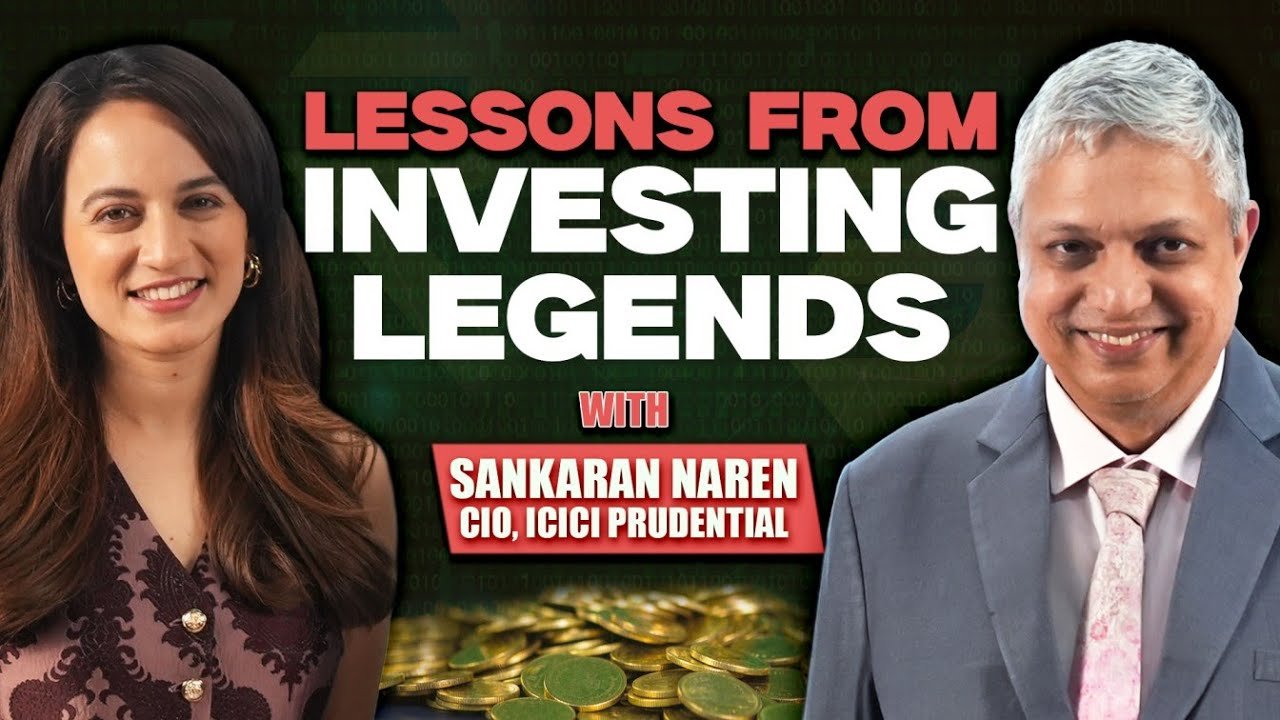

On this episode of The Money Mindset, we have someone who is a legend in the mutual fund industry, Sankaran Naren is the CIO of ICICI prudential, who manages almost 11 lakh crores of public money and has been a part of the mutual fund industry for over 3 decades.

He is well known in market circles to be a contrarion investor, someone who swims against the tide.

On this episode, we spoke about lessons from his mentors like Howard Marks, Michael Mobussin and Peter Lynch.

He is known for his strong emphasis on valuation discipline, risk management and multi-asset investing, and for being willing to go against the consensus when markets are driven more by narratives than fundamentals.

What stands out in his approach is the balance between conviction and humility, an understanding that while markets can’t be predicted, being prepared and positioned correctly has repeatedly mattered for long-term outcomes.

on this episode, we drew on that experience to discuss how investors can think about long-term investing, behavior, asset allocation, and building portfolios that are designed to endure uncertainty rather than chase short-term returns.

0:00 Intro

2:39 Vulnerable market?

4:00 Headed for protracted bear market?

10:34 Market cycle pendulum?

12:55 Sectoral bias?

17:05 Contrarian investing

21:51 Silver’s Euphoria

23:34 Macro trends India

28:04 Investments & learnings

31:58 Study market cycle

39:00 Stock adjustments?

41:04 Behavioral mistakes

44:40 When to sell?

46:46 Dealing with pressure

50:10 Portfolio management

52:14 Michael Mobussin’s learnings

56:27 S. Naren’s Journey

58:23 Multi assets

59:12 Mindset changes

About the Money Mindset Podcast

Hosted by Sonia Shenoy, Money Mindset is a podcast that brings together top investors, business leaders, and financial experts to decode wealth-building strategies, investment philosophies, and money management tips. Whether you’re an aspiring investor, a finance professional, or someone looking to gain insights from market veterans, Money Mindset offers engaging, insightful, and practical conversations to help you make informed financial decisions.

🔔 Don’t forget to Like, Share, and Subscribe for more enriching conversations with industry leaders and trailblazers.

#mutualfunds #investing #wealth

source

@soniashenoyofficial

Thank you for being here. Naren was one of the first few to caution about the small and midcaps way back in September 2024, and it played out exactly that way. On this episode I spoke to him about his view on the market and how to approach the new year. We also spoke about his lessons as a student of contrarion investing , lessons from Howard marks, James montier , Michael Mobussin and lots more. Hope you enjoy this episode. Merry Xmas 🎄 ❤

@srinivasgujjari4543

Thank youvSir and Mam

@nikitagarg4399

1:01:16 That SOME BIG DAY is like being able to predict if you will certainly go to BAIKUNTH after you are gone.

@yuviiiiiiiiiiiiiiiii

Great insights. Kudos Sonia for a great interview. Would be great if you can bring in someone who is one of the best at swing trading or Short term trading as well!

@dharmateja623

Wow, what a podcast—full of genuine wisdom without any nonsense. Every minute, Naren Sir shares valuable insights. I truly respect and admire him. 🙇

@deepaklad7979

Excellent discussion ❤❤❤

@jagdishpatel-cn9ty

Investing is not zero sum game but trading in f&o in zero sum game

@hotel.unlocked

His smile 😂😂

@v.d.8760

34:00 The real video starts from here. Human behaviour gets change when market votality arrives and S.Naren discuss real life experience from here…🔥🙇

@vju2ub

Go back to your day job and make money there, leave investing to Pros. That said, momentum trading works, if you work on the skill – that is your edge MutualFunds don’t have.

@sureshpalsingh1430

Great learning 👍

@varunmohanraj1015

@soniashenoyofficial Pls try to get Keshav Garg , Govind parikh , Naresh Katariya & Basant Maheshwari

@VivekGupta-x8j1x

I liked the formula of buying a contra bet ❤️

@JineshBagadia16

Hey Sonia — I'm not sure if I understand the "Investing is a zero sum game" bit. There was no counter-question from you on that, so I'm assuming you understood what he meant to say. Request you to help me understand that…or reach out to him again for an explanation.

It's pretty much the exact opposite of what we've learnt and experienced till now, hence not pushing back for an explanation is cheating with our own understanding of the markets. Thanks.

@mahipalgaddam6238

Is investing zero sum game?

@ashishkharche

A big respect to you sir!

The way you put the concept of how people should look at making money decisions thats so perfect..

@amitSriva

No, investing is not zero sum game

@SP-BHAI_SAAB

Worth or Worst listening?😂

@HRC-letsknow

Please invite Prashant Jain Sir.

@Harsh-bn3ql

Excellent nuggets on investing💰

Well anchored Sonia 👏🏻

@ghatwolf1247

Lovely discussion!! Good knowledge imparting session!

@fasalraman1000

The one of real Bees is Only Mr Naren in the Ceos of AMC in in India

@AshokJaipurwala

Detachment from the money allows to make money ❤

@chaitanya3069

great conversation

@CAVamikaTripathi

Very insightful podcast. Thank you Sonia for hosting such wisdom packed podcasts with accomplished and seasoned investors!

@vivekdogra486

Nice. Pls also cover gem stocks like castrol, orient ceratech, goodyear and engineer india.

@swarnadipchatterjee

Please bring Samit Vartak of SageOne.

@vachaspatidubey3576

Sale switch concept is very good take away for me

@saikat11021

He himself not clear about market and his thoughts represents the same. No output of this conversation sorry 😊

@swarnadipchatterjee

32:32 – 32:50 : everything of this podcast and his investment philosophy in a nutshell. Also the chapter on behavioural mistakes is a must watch!

@vaithi91psg

No fancy words, no fancy data… The usual "Be positive; Be cautious" mindset getting reflected… It's a great pleasure to listen to Mr. S Naren……