▼FREE Investing Infographic eBook:▼

📚 https://longtermmindset.co/investing

▼Shop Our Store: ▼

🛒 https://www.longtermmindset.co/store

▼ABOUT US:▼

👨💼Brian Feroldi is an author (https://amzn.to/3JVr9Q0), investor, YouTuber, and financial educator. He’s been investing in the stock market since 2004. Brian likes to buy and hold the highest quality companies he can find.

👨💼Brian Stoffel is a writer, investor, YouTuber, and financial educator. He’s a teacher at heart. Brian has been investing for over a decade and has written over 4,000 articles for The Motley Fool. Brian plans his life and his investments around “antifragile” principles.

❗️❗️DISCLAIMER:❗️❗️

All content on this channel is for discussion, education, entertainment, and illustrative purposes only and SHOULD NOT be construed as professional financial advice, solicitation, or recommendation to buy or sell any securities, notwithstanding anything stated on this channel. There are risks associated with investing in securities. Loss of principal is possible. Past performance is not a predictor of future investment performance. Brian Feroldi and the guests on this channel are not responsible for investment actions taken by viewers. Should you need such advice, consult a licensed financial advisor, legal advisor, or tax advisor. You agree to verify all information yourself before investing. Any past performance discussed during this program is no guarantee of future results. Investing involves risk and possible loss of principal capital; please seek advice from a licensed professional.

All views expressed are personal opinions as of the date of recording and are subject to change without the responsibility to update views. No guarantee is given regarding the accuracy of the information on this channel. Releasees undertake no obligation to provide accurate or sound investment statements. You waive any and all duties that may exist flowing from you to any Releasee. You agree not to hold any Releasee liable for any possible claim for damages arising from any decision you make based on information or other content on the Channel.

*Some of the links and other products in this video are from companies for which Brian Feroldi will earn an affiliate commission or referral bonus. Brian Feroldi is part of an affiliate network and receives compensation for sending traffic to partner sites. The content in this video is accurate as of the posting date.

source

@trulybudget.official

This is amazing 😅❤

@nicoleg4536

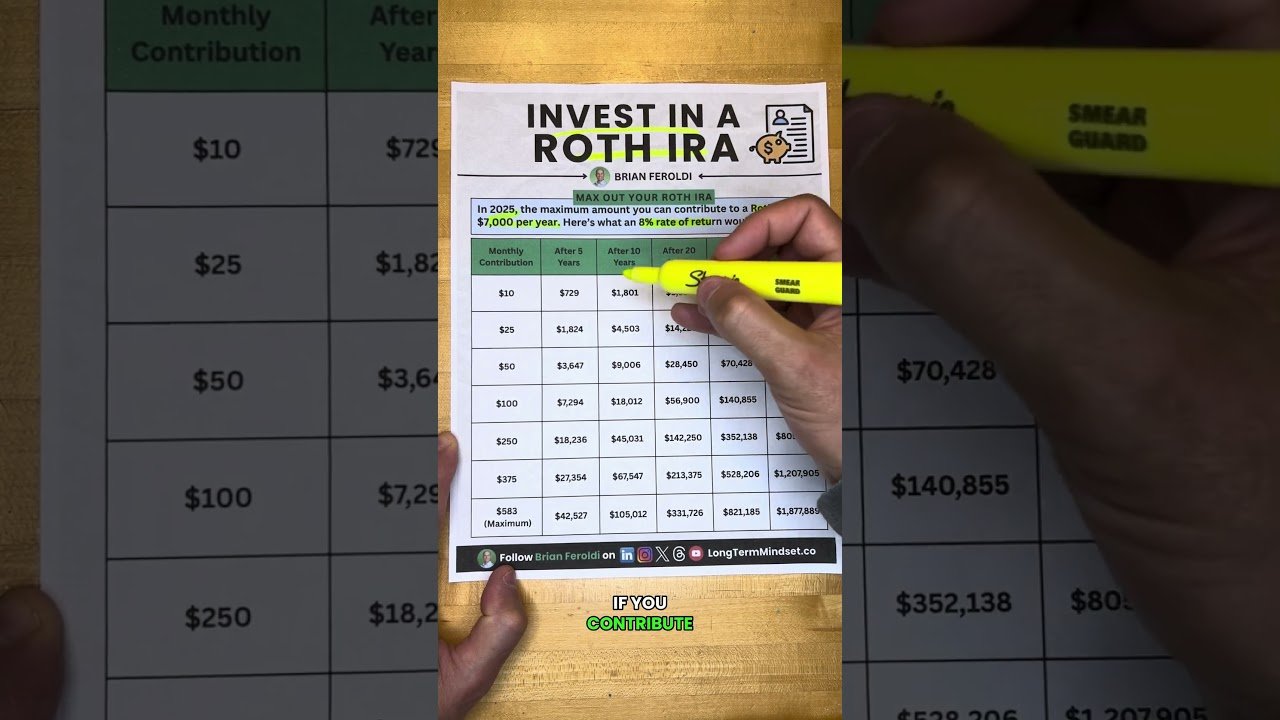

I’m still learning so be easy on me lol. So to accomplish , do you have to put in 7k first then do the monthly contributions that’ll get in the return on investment years later? Like put in 7k and then depending on how much you contribute will determine the growth? Thank you!

@potatochobit

If I have 100,000$ cash is this a good idea or buy CD and treasury yearly?

@user-ro2li3eb4s

yes good to know for a 20 year old. I am cooked.

@CasualDudeGaming

so the sooner the better, well i'm already 30. I'm fcked.

@GaryMKnows

Seeing how your money will grow visually makes a big difference. Every Kid in high school should be taught this concept.

@bighou2359

But…..in 40 yrs I'll be dead and can't do anything. Welp, F this.

@CuriousWoman1029

Can you do a visual model of a traditional 401(k)? This visual model was so helpful!

@mauricehobbs9426

In 40 years ill be 70😭

@bronsonequity

Awesome motivation here.

@donaldmyers6820

Not exactly true about the taxes. Instead of getting a tax deduction on your contributions, you pay your taxes upfront, but qualified withdrawals in retirement are completely tax-free.

@donaldmyers6820

Dumb luck serves me best. Bought Bitcoin years ago. Now I have more money than I'll ever be able to spend in my life and don't even have to cash out. 😊

@민이-f5v

i'm 25 and this video is perfect.

@somethingaboutsamantha

Don’t forget to invest it after it’s in the ROTH

@srstapleton54

The only thing I have to ask you is can you now tell us WHAT to invest that monthly amount into because that’s where I’m stuck as a beginner. I know that once I get started I won’t be so stuck in thought rather I’ll be doing this on auto pilot with confidence.

What should my Roth Portfolio be comprised of because I’m having a hard time deciding which to pick like VOO, FXAIX, SPY, and the options go on, but I just need help picking. I know I will be good with choosing the right amount to invest and I’m going to set it on auto, then once I hit my 7,000 then I’ve hit it but should I pick 3 and give a certain percentage to each or should I pick one…

Thank you for your help!

My Fidelity Roth and Brokerage are all set and ready so it’s my time to shine! My income is the highest it’s ever been, I have zero debt, and very little bills, so I can start with a very good number.

Any direction from anyone would be greatly appreciated!

I also need to pick what I want to go for in my Brokerage if anyone has time to help me!

@jsmythib

Brought to you by our favorite wall street lobby.

@iversondelanuez1629

but why would u want to be a millionaire at 60? at that point who knows how the world is gonna be lol

@TheBannyMan

what if i just put 7k in on jan 1st

@kccustom1

I wish I learned this 30 years ago

@MindfulHarDev

Clients are fortunate to have your guidance

@hannahwhite6083

I’m just learning now. Are there different types of Roth IRA accounts?

@notafishstick

You can’t survive with that retirement

@Wannostaychill

So what would happen if I just put my $7,000 in a at one time how much would I get back

@TheMultiHobbyGuy

Okay, but on a serious note. Would just over 1 million be enough in the future when you retire, due to inflation?

@salravioli

Where can I get this printout?

@scienz

but you cant just start a roth ira by just putting in money. you have to choose where it gets invested. how do you choose that part?

@rdstudios-production

What are the investments in? Is this basing it off S&P?

@JayZ-to6up

Wow! What a stupid illustration. Lol. What horrible terms! Lol. After 40 years look at the end result. AFTER 40 YEARS LOL what you'll have sucks! And who knows what that end number you'll have in your ira what kind of buying power it'll have after 40 years of inflation. This is the bullshit scam Wall Street wants you to buy into and pay for their services for the next 40 years. Not to mention the rate of return is hypothetical, it is not guaranteed. Not to mention to get the best end result you have to contribute over $500 dollars a month for the next 40 years which most people won't be able to do. Maybe not even the halfway number of $250 a month for the next 40 years to get a little over $800,000 after 40 years and who knows what that amount will be worth after 40 YEARS OF INFLATION. FCK this Wall Street financial plan. Which funds Wall Streets lovely fees and costs for the next 40 years. What a great plan for them.

@JohanwalliamJames

Good

@UncleSwell707

If you AUTOMATE it (like im currently doing), you can also be hands off with your ROTH IRA. I automate the transfer from my bank to my ROTH IRA account….and i also automate the actual investment ETF, so it automatically invests every month as well. That way, i set it and forget it…and just check up on it every week.

@arodcheri

Well damn I'm 43 now so I can't retire onna roth until 83? 😢

@myguitartwerks7825

Only if youre expecting to live up to the age of 59 1/2

@captainobvious5256

just 40 more years to go everyone. this totally isnt a scam.

@Fathrdan

I have a Roth IRA account with Sofi but i have to invest it further? Its only amounting to whatever I deposit I don’t see anything changing as far as interest or anything. After I deposit do I have to further invest? I’m confused

@Averagegamers0

I just learned about this at 23 and I feel like I’m too late already lol. Just opened mine two days ago.

@mawenshan5555

Just checked my bank only offers about 4%. Wonder which bank offers 8%

@jgarcia10s

I also can get a 401k roth….what the max contribution on that?

@Lilskixxx

So what I'm hearing is that drip still hits significantly harder

@Jaytaxfree

choida!! just imagine if market crashes by retire age. there's no safety. if you need tax free investment with you can set the limit with 0% floor protection let me know

@SakuraHimiar

So how do I start this I was on YouTube looking at RVs and I am just now finding out about Roth? Never heard of it how do you start I am 22 and don’t plan on working into I die so gotta start this ASAP😂

@user-sg6xe9cl3k

I’ve put in so much time and effort, studying through courses, reading books, and joining webinars, but this market keeps testing me, especially with all the recent dips. I’m not chasing fast profits; I just want consistent results.><< Is there anyone out there who actually trades and teaches in real time, not just talks theory?