"https://i.ebayimg.com/images/g/GOAAAOSwmCVY94Rj/s-l500.jpg" />

Item specifics

- Condition

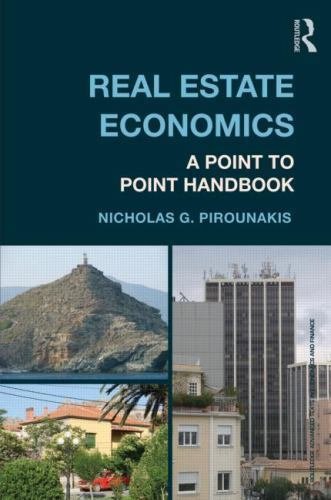

- Book Title

- Real Estate Economics : A Point-to-Point Handbook

- ISBN

- 9780415676359

- Subject Area

- Business & Economics

- Publication Name

- Real Estate Economics : a Point-To-Point Handbook

- Publisher

- Routledge

- Item Length

- 9.7 in

- Subject

- Urban & Regional, Investments & Securities / Real Estate, Real Estate / General, General, Econometrics

- Publication Year

- 2013

- Series

- Routledge Advanced Texts in Economics and Finance Ser.

- Type

- Textbook

- Format

- Trade Paperback

- Language

- English

- Item Height

- 1.1 in

- Item Weight

- 32.1 Oz

- Item Width

- 6.9 in

- Number of Pages

- 484 Pages

Real Estate Economics : A Point-to-Point Handbook, Paperback by Pirounakis, N…

About this product

Product Identifiers

Publisher

Routledge

ISBN-10

0415676355

ISBN-13

9780415676359

eBay Product ID (ePID)

112870217

Product Key Features

Number of Pages

484 Pages

Language

English

Publication Name

Real Estate Economics : a Point-To-Point Handbook

Publication Year

2013

Subject

Urban & Regional, Investments & Securities / Real Estate, Real Estate / General, General, Econometrics

Type

Textbook

Subject Area

Business & Economics

Series

Routledge Advanced Texts in Economics and Finance Ser.

Format

Trade Paperback

Dimensions

Item Height

1.1 in

Item Weight

32.1 Oz

Item Length

9.7 in

Item Width

6.9 in

Additional Product Features

Intended Audience

College Audience

LCCN

2012-012458

Illustrated

Yes

Table Of Content

Preface 1. Real Estate (RE): An overview of the sector 2. RE: Tools of analysis 3. RE in the Wider Economy 4. RE Finance: Loans, equity withdrawal, MBSs 5. RE as an Investment Decision 6. Demand for Office – Retail – Industrial Space 7. Housing Demand and Supply 8. Construction Flows and Market Equilibrium 9. RE Taxation 10. Land Uses, Values, and Taxation 11. Housing Market Bubbles 12. RE Performance and Price Measures Epilogue

Synopsis

Real Estate Economics: A point-to-point handbook introduces the main tools and concepts of real estate (RE) economics. It covers areas such as the relation between RE and the macro-economy, RE finance, investment appraisal, taxation, demand and supply, development, market dynamics and price bubbles, and price estimation. It balances housing economics with commercial property economics, and pays particular attention to the issue of property dynamics and bubbles – something very topical in the aftermath of the US house-price collapse that precipitated the global crisis of 2008. This textbook takes an international approach and introduces the student to the necessary ‘toolbox’ of models required in order to properly understand the mechanics of real estate. It combines theory, technique, real-life cases, and practical examples, so that in the end the student is able to: * read and understand most RE papers published in peer-reviewed journals; * make sense of the RE market (or markets); and * contribute positively to the preparation of economic analyses of RE assets and markets soon after joining any company or other organization involved in RE investing, appraisal, management, policy, or research. This book should be particularly useful to third-year students of economics who may take up RE or urban economics as an optional course, to postgraduate economics students who want to specialize in RE economics, to graduates in management, business administration, civil engineering, planning, and law who are interested in RE, as well as to RE practitioners and to students reading for RE-related professional qualifications., Real Estate Economics: A point-to-point handbook introduces the main tools and concepts of real estate (RE) economics. It covers areas such as the relation between RE and the macro-economy, RE finance, investment appraisal, taxation, demand and supply, development, market dynamics and price bubbles, and price estimation. It balances housing economics with commercial property economics, and pays particular attention to the issue of property dynamics and bubbles – something very topical in the aftermath of the US house-price collapse that precipitated the global crisis of 2008. This textbook takes an international approach and introduces the student to the necessary ‘toolbox’ of models required in order to properly understand the mechanics of real estate. It combines theory, technique, real-life cases, and practical examples, so that in the end the student is able to: – read and understand most RE papers published in peer-reviewed journals; – make sense of the RE market (or markets); and – contribute positively to the preparation of economic analyses of RE assets and markets soon after joining any company or other organization involved in RE investing, appraisal, management, policy, or research. This book should be particularly useful to third-year students of economics who may take up RE or urban economics as an optional course, to postgraduate economics students who want to specialize in RE economics, to graduates in management, business administration, civil engineering, planning, and law who are interested in RE, as well as to RE practitioners and to students reading for RE-related professional qualifications., Real Estate Economics: A point-to-point handbook introduces the main tools and concepts of real estate (RE) economics. It covers areas such as the relation between RE and the macro-economy, RE finance, investment appraisal, taxation, demand and supply, development, market dynamics and price bubbles, and price estimation.

LC Classification Number

HD1375.P656 2012

Price : 134.10

Ends on : N/A

View on eBay