"https://i.ebayimg.com/images/g/oPsAAeSwOrlpYsfP/s-l500.jpg" />

Item specifics

- Condition

- Release Year

- 2010

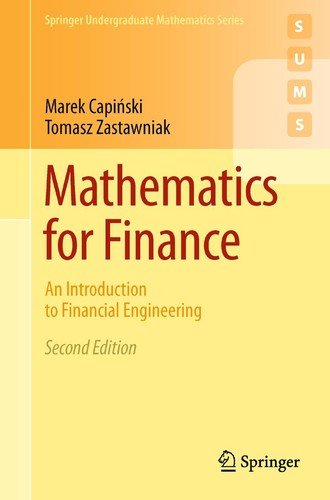

- Book Title

- Mathematics for Finance: An Introduction to Financial Engineer…

- ISBN

- 9780857290816

- Subject Area

- Mathematics, Business & Economics

- Publication Name

- Mathematics for Finance : an Introduction to Financial Engineering

- Publisher

- Springer London, The Limited

- Item Length

- 9.3 in

- Subject

- Finance / Financial Engineering, Finance / General, Investments & Securities / Analysis & Trading Strategies, Applied, Business Mathematics

- Publication Year

- 2010

- Series

- Springer Undergraduate Mathematics Ser.

- Type

- Textbook

- Format

- Trade Paperback

- Language

- English

- Item Weight

- 38.4 Oz

- Item Width

- 6.1 in

- Number of Pages

- Xiii, 336 Pages

Mathematics for Finance: An Introduction to Financial Engineering (Springer …

About this product

Product Identifiers

Publisher

Springer London, The Limited

ISBN-10

0857290819

ISBN-13

9780857290816

eBay Product ID (ePID)

99586256

Product Key Features

Number of Pages

Xiii, 336 Pages

Language

English

Publication Name

Mathematics for Finance : an Introduction to Financial Engineering

Publication Year

2010

Subject

Finance / Financial Engineering, Finance / General, Investments & Securities / Analysis & Trading Strategies, Applied, Business Mathematics

Type

Textbook

Subject Area

Mathematics, Business & Economics

Series

Springer Undergraduate Mathematics Ser.

Format

Trade Paperback

Dimensions

Item Weight

38.4 Oz

Item Length

9.3 in

Item Width

6.1 in

Additional Product Features

Edition Number

2

Intended Audience

Scholarly & Professional

LCCN

2010-938854

Dewey Edition

21

Reviews

From the reviews of the second edition:This second edition … is to start each chapter with the presentation of a case study and to end each chapter with a thorough discussion of that study. The authors also added new material on time-continuous models, along with the essentials of the mathematical arguments. … The current book is more substantial … . Summing Up: Recommended. Upper-division undergraduates and graduate students. (D. Robbins, Choice, Vol. 48 (10), June, 2011)Throughout the text, the authors invite active reader participation. One way is by opening and closing each chapter with a case study. … authors have embedded all of the exercises in the discussion. … Solutions to all exercises appear in an appendix. This makes the book excellent for self-study. … this book provides an excellent introduction to financial engineering. … authors display impressive dexterity in ushering the reader from basics to an understanding of some of the deepest and most far-reaching ideas in the discipline. (David A. Huckaby, The Mathematical Association of America, February, 2011), From the reviews of the second edition:This second edition … is to start each chapter with the presentation of a case study and to end each chapter with a thorough discussion of that study. The authors also added new material on time-continuous models, along with the essentials of the mathematical arguments. … The current book is more substantial … . Summing Up: Recommended. Upper-division undergraduates and graduate students. (D. Robbins, Choice, Vol. 48 (10), June, 2011), From the reviews of the second edition: “This second edition … is to start each chapter with the presentation of a case study and to end each chapter with a thorough discussion of that study. The authors also added new material on time-continuous models, along with the essentials of the mathematical arguments. … The current book is more substantial … . Summing Up: Recommended. Upper-division undergraduates and graduate students.” (D. Robbins, Choice, Vol. 48 (10), June, 2011) “Throughout the text, the authors invite active reader participation. One way is by opening and closing each chapter with a case study. … authors have embedded all of the exercises in the discussion. … Solutions to all exercises appear in an appendix. This makes the book excellent for self-study. … this book provides an excellent introduction to financial engineering. … authors display impressive dexterity in ushering the reader from basics to an understanding of some of the deepest and most far-reaching ideas in the discipline.” (David A. Huckaby, The Mathematical Association of America, February, 2011) “This second edition consists of standard topics for undergraduate level financial mathematics courses, plus an introduction to materials from an advanced level course. … Each chapter starts with a case study and ends with a discussion on it using the material taught in the chapter. In general this book provides many examples and exercises, which is very useful for helping readers to understand the materials covered. Overall this is a great book for upper level undergraduate students and those who want to self-study financial engineering.” (Youngna Choi, Mathematical Reviews, Issue 2012 e) “This textbook presents … three major areas of mathematical finance at a level suitable for second or third year undergraduate students in mathematics, business management, finance or economics. … The text is interspersed with a multitude of elaborated examples and exercises, complete with solutions, providing ample material for tutorials as well as making the book good for self-study.” (Yuliya S. Mishura, Zentralblatt MATH, Vol. 1207, 2011)

Number of Volumes

1 vol.

Illustrated

Yes

Dewey Decimal

332.6/01/51

Table Of Content

A Simple Market Model.- Risk-Free Assets.- Portfolio Management.- Forward and Futures Contracts.- Options: General Properties.- Binomial Model.- General Discrete Time Models.- Continuous Time Model.- Interest Rates.

Synopsis

A Simple Market Model.- Risk-Free Assets.- Portfolio Management.- Forward and Futures Contracts.- Options: General Properties.- Binomial Model.- General Discrete Time Models.- Continuous Time Model.- Interest Rates., Mathematics for Finance: An Introduction to Financial Engineering combines financial motivation with mathematical style. Assuming only basic knowledge of probability and calculus, it presents three major areas of mathematical finance, namely Option pricing based on the no-arbitrage principle in discrete and continuous time setting, Markowitz portfolio optimisation and Capital Asset Pricing Model, and basic stochastic interest rate models in discrete setting.

LC Classification Number

H61.25

Price : 18.67

Ends on : N/A

View on eBay