▼WARREN BUFFETT’S FINANCIAL RULES OF THUMB PDF:▼

🔗 https://longtermmindset.co/buffett

▼ABOUT US:▼

👨💼Brian Feroldi is an author (https://amzn.to/3JVr9Q0), investor, YouTuber, and financial educator. He’s been investing in the stock market since 2004. Brian likes to buy and hold the highest quality companies he can find.

👨💼Brian Stoffel is a writer, investor, YouTuber, and financial educator. He’s a teacher at heart. Brian has been investing for over a decade and has written over 4,000 articles for The Motley Fool. Brian plans his life and his investments around “antifragile” principles.

❗️❗️DISCLAIMER:❗️❗️

All content on this channel is for discussion, education, entertainment, and illustrative purposes only and SHOULD NOT be construed as professional financial advice, solicitation, or recommendation to buy or sell any securities, notwithstanding anything stated on this channel. There are risks associated with investing in securities. Loss of principal is possible. Past performance is not a predictor of future investment performance. Brian Feroldi and the guests on this channel are not responsible for investment actions taken by viewers. Should you need such advice, consult a licensed financial advisor, legal advisor, or tax advisor. You agree to verify all information yourself before investing. Any past performance discussed during this program is no guarantee of future results. Investing involves risk and possible loss of principal capital; please seek advice from a licensed professional.

All views expressed are personal opinions as of the date of recording and are subject to change without the responsibility to update views. No guarantee is given regarding the accuracy of the information on this channel. Releasees undertake no obligation to provide accurate or sound investment statements. You waive any and all duties that may exist flowing from you to any Releasee. You agree not to hold any Releasee liable for any possible claim for damages arising from any decision you make based on information or other content on the Channel.

*Some of the links and other products in this video are from companies for which Brian Feroldi will earn an affiliate commission or referral bonus. Brian Feroldi is part of an affiliate network and receives compensation for sending traffic to partner sites. The content in this video is accurate as of the posting date.

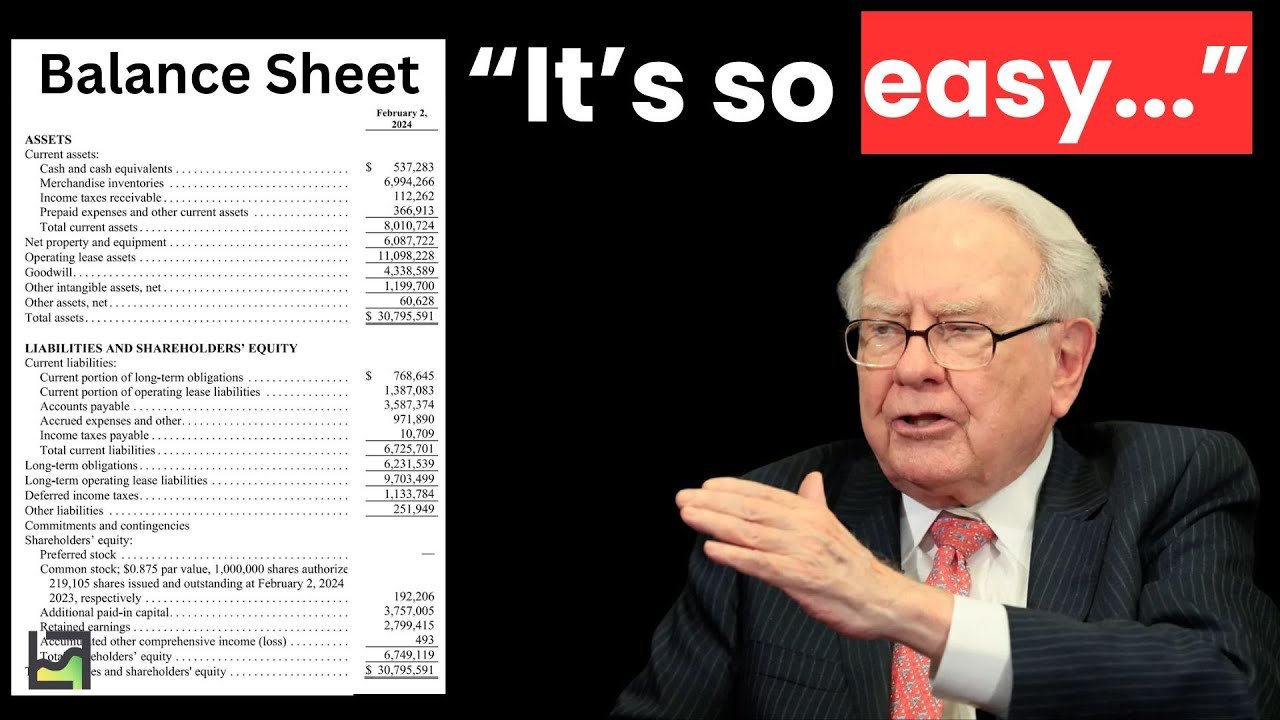

0:00 Balance Sheet Overview

0:49 Buffett’s Balance Sheet Rules

4:27 Chipotle Balance Sheet

source

@BrianFeroldiYT

Thanks for watching! Download a free copy of Buffett’s rules of thumb here: http://longtermmindset.co/buffett

@SteelFabricator-os7sx

The first rule as presented here is dead wrong. There are no businesses that have more cash and cash equivalent than short term and long term debt. Look at coca cola which is one that Buffet has held for a long time.

@Charles-l6h4b

I downloaded the Buffett Rules. All it is is a list of questions. No formulas at all. Useless.

@redswingline262

#6 – no dividends

@MalvinderKaur-e7x

today you have programs apps doing it much better for heavens sake grow up to tech age idiots…financial statements can be forged fake.. so there are plenty of other ways to find what is true finances of any company, well, those will be told in my consultation fees paid.

@lespritmunger

🎉its amazing

@RichardAyres-l3r

There is no x in especially.

@jimhargrave3

Nancy Pelosi did much better investing than Buffet!! How is that??

@redstone5149

Guy works for Chipotle. Ignores Buffets rules and gives them a check anyway😂

@davidwilson7766

You said the company has a "debt free balance sheet" at 5:05. If that were true, then the debt to equity would be 0… $0 / equity = $0

@changsong-wj4zs

.

@JonathanPoland

Have you read zero annual reports? Rule #1 is NOT true. He also didn't create the rule. It was Ben Graham. Rule #2 is NOT true either. He looks at whether the company can pay its debts off in a timely period with net income not how much debt/equity it has, and even that rule he's broken several times. Rule #3 is NOT true either. He has famously used preferred stock purchases as a funding tool, often during times of financial distress or uncertainty for the companies involved. BRK owned preferreds on GE, BAC, GS, OXY all BIG MASSIVE positions. Cities Service Preferred was BUFFETT'S first stock at 11. Rule #4 IS true, but you miss the most important calculation. Every dollar of retained should create a dollar or more of market value. Without that it's meaningless to keep. Many stocks he's bought have negative retained. Rule #5 IS true. But it's not as important to buy back stock if you can put that money into growth elsewhere more productively. It's kind of like a "well I have too much money, I have to do something with it, let's buy back our stock…" the problem is that Buffett also doesn't condone doing it at high prices, which invariable means he is agnostic to this one.

@DossieSingers

Never trust a man that can't pronounce "Expecially" haha

@DuskAmplifier

and if you bought Chipotle after this, you'd be down 50%. 🙁

@lostcraver

You contradict yourself by saying the Chipotle has no debt (in reality it does, as long term leases are considered as long term obligations), then a few seconds later you say they have a debt/equity ratio of 1.2

@Orgilican

Thank you for the explanation, it is very helpful for me as a beginner.

@romansolomatin2313

I wish I could disable in-video subtitles…

@stephenvickers6251

Slow down when you talk. You rattle off the statements to quick

@nancysmith9487

What if balance sheets are in correct fabricated numbers

@jeffyeung6657

I think there're tons of exceptions for number 2. For example, Apple has been buying back stocks above book value over the years. That led to equity being reduced, in some other cases, to the negative territory. Warren said there's nothing wrong with it. But again, one might have to look deeper and make a lot of exceptions to check the number 2 box.

@VICTORVONDOOM4

Basically, blue chip companies?

@elwinharrison1099

Could you add a link the website you used to get the financial information.

@Dave-lr2wo

Good video. Please practice pronouncing "especially" correctly. And try to avoid pronouncing "str" words with SH. It's strong, not shtrong, etc.

@FinTalks-s2o

really good strategies, but execution is too difficult

@NotJames3725

Explained then demonstrated 👍🏻 = Winner!

@dagwould

"Why does he have this rule of thumb in place?" What does 'in place' add to the meaning of he questions? A: nothing. Just "Why does he have this rule of thumb" says it all. The verb 'have' does all the heavy lifting.

@reachmemalay

Thank you this was quite insightful!

@user-gn1ic9ww8q

once out on bad terms also means that person or persons arent allowed to be employeed by any my companies, they arent aloowed to live in any my places, either or arent allowed in any my vehicles.

@7sistersenterpriseinc142

Wow, I used to not understand a company's balance sheet. 😅 Thanks for a clear explanation of this. I am starting to invest and this helps me tremendously. 👍 I also read people's comments and suggestions. Good to know..

I am a new subscriber. 😊

@JerryUpchurch-f2o

What company does he own that has more cash than debt?

@fraserhardmetal7143

There's one fundamental thing that all these accountants, analysts, and investors omit in their take downs and predictions.

Not one of them had the ability or the balls to create a business, a company or an enterprise. All these people are capable of is juggling other peoples money and profiting on economic downturns.

@tomspreadbury2915

You Don't need Buffett to tell you this. Any accountant or Finance analyst of any kind, and most consultants in finance can tell you all of this.

@angeloeliopoulos2317

U sound stupid when u pronounce it ekspecially. Just saying.

@GianiStuparich

Why a so pushy spamming? Unacceptable

@bowtoyoursensei1

Its pronounced ES-pecially not EKS-pecially

@lylalee7084

You are so passionate in providing biased information with marketing fluffs to create a cult of personality.

@CCave-wj6xy

Warren doesn't want to see the company to have any preferred stock unless they're issuing it to him And him alone… On ridiculously favorable terms.

@ViloiLewis

Please send me buffet rule of thumb strategic balance sheet analysis

@maurocafi3062

Strane parole per uno, come BUFFETTO, che si è messo TUTTO IN TASCA: Cioè non ha dato mai una lira ai suoi azionisti e in più a goduto di un aumento stratosferico della massa monetaria MONDIALE!?

Ai suoi azionisti, ha dato solo l'ELEMOSINA della salita del titolo, quando c'è stata e per chi ha indovinato i tempi, ma il SUCCO dei capitali l'ha ciucciato TUTTO LUI. ALLA FACCIA MOSTRA!

@artherrera4669

You are totally wrong. Preferred Stock is not an hybrid between debt and equity. Preferred stocks are just stocks with other additional conditions to shareholders like additional profit during profit distribution, etc.