Everybody’s screaming “AI bubble!” “Nvidia failed!” “Crypto panic!” like that’s the whole story… but that’s not what’s really shaking this market, fam.

In this video, I break down why this sell-off is NOT about an AI bubble, NOT about Nvidia missing, and NOT just about Bitcoin bleeding – it’s about global liquidity tightening in real time and a money game that 95% of investors don’t even track.

If you’ve been confused like:

“How did Nvidia CRUSH earnings and the market STILL fall apart?”

…this is the episode that’s going to give you that “ohhhh, THAT’S what’s going on” moment.

I’m walking you through the yen carry trade, why cheap Japanese money has been fueling U.S. stocks, crypto, and risk assets for decades… and how one move in Japan’s bond market forced investors all over theworld to dump assets at the same damn time.

By the end of this video, you’re going to see the market completely different.

You’ll stop blaming the wrong things… and start watching the right levers.

💡 What I Break Down In This Video

🚫 Why this is NOT an AI bubble – and why Nvidia actually did its job

🧨 How one Fed comment flipped the vibe from “Nvidia, please save us” to “full-blown panic”

📉 Nvidia adding $450B in market cap… then losing it and closing red

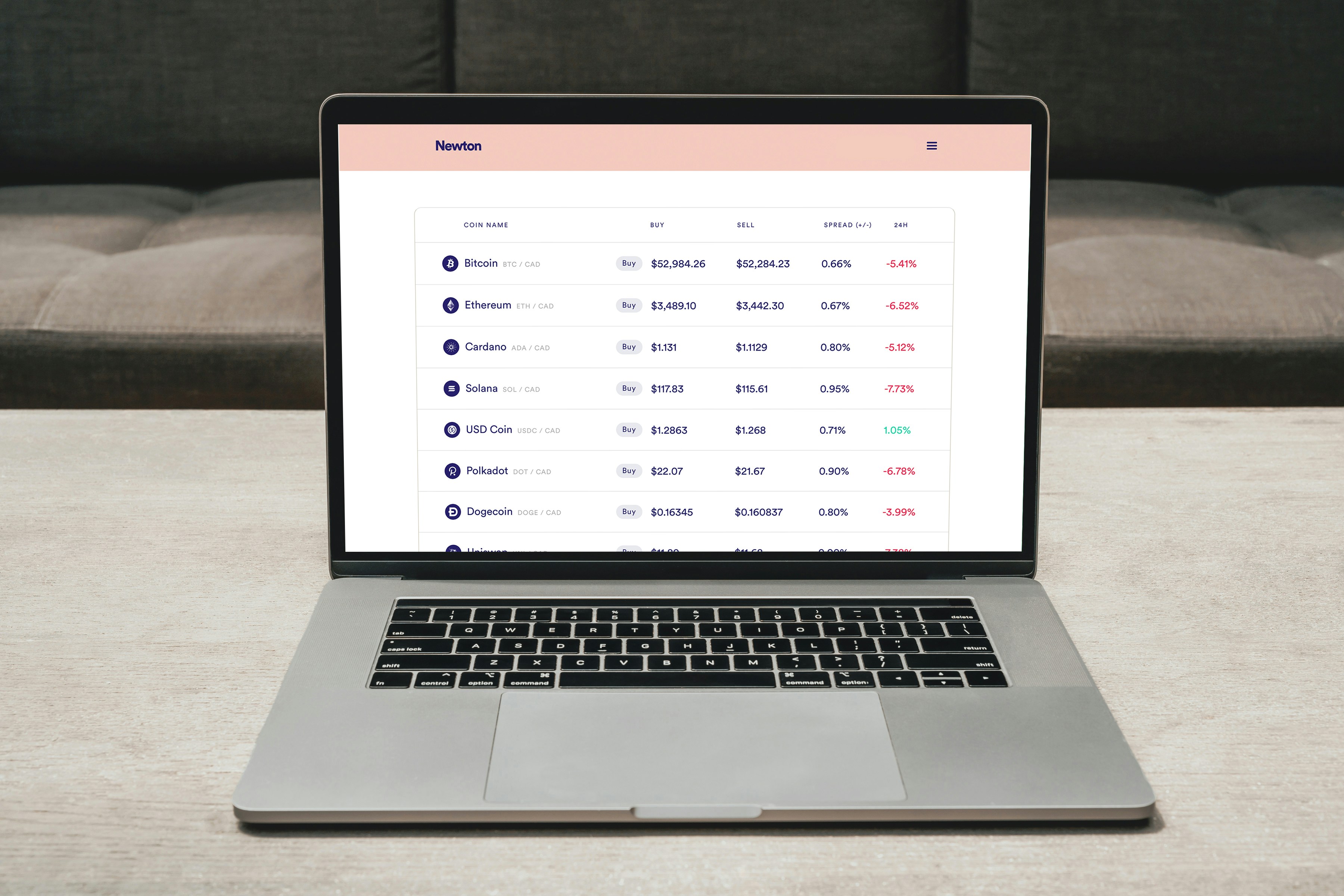

🧊 Crypto sliding deeper into a bear market overnight

🏚️ Real estate defaults, Rich Carlton partners folding, and why that wasn’t the real trigger

Then we get into the real villain behind the move:

💴 The Japanese yen carry trade explained in plain English

Borrow cheap from Japan, flip it into U.S. stocks, bonds, real estate, crypto, emerging markets

Pay Japan back with pennies and keep the spread

🌏 Why 7–10 TRILLION dollars is tied to the yen – and what happens when the yen gets stronger

🧯 What investors do when the yen spikes:

Liquidate everything: stocks, crypto, real estate, risk assets

Run for liquidity so they can unwind those yen loans

📰 The headlines they gave you vs what was really going on

“Japan yield shock threatens global markets”

“Bitcoin may be next”

SoftBank dumping a $5.8B Nvidia stake – not because they hate AI, but because Japan is under pressure and they need cash

Then I tie it all together:

📊 Yen charts vs SPY and the U.S. market – you literally see them move together

🧵 How this same yen drama showed up before in 2024 and triggered another sell-off

🧠 Why money is tied together and nothing is a coincidence

🧭 What this means for YOUR 401k, retirement, and AI/crypto positions going forward

👀 What to watch now:

The yen

Fed rate cut odds

Volatility every time global liquidity gets squeezed

I’m still breaking down the S&P 500 (SPY), the Nasdaq, and two stocks I’m watching, so you don’t just get the macro story – you get the game plan.

Join our Exclusive Patreon!!!

https://hubs.ly/Q03thsJt0%F0%9F%92%8E%F0%9F%92%8E%F0%9F%92%B8%F0%9F%92%B8

Join Trappers Anonymous: https://hubs.ly/Q03thxbW0

Disclaimer

Education only. Not financial advice. Do your own research and manage risk.

⏱️ CHAPTERS

00:00 – This Is NOT an AI Bubble (Real Reason Markets Are Shaking)

01:11 – Trap Door Week: Nvidia Earnings, J. Powell & Instant Panic

03:30 – The Invisible Force: Global Liquidity Tightening

03:37 – Intro to the Yen Carry Trade (Explained Without Wall Street Jargon)

04:35 – How Cheap Japanese Money Fueled U.S. Stocks, Crypto & Real Estate

05:21 – “Japan Yield Shock” & SoftBank’s $5.8B Nvidia Sale

06:10 – Why a Stronger Yen Forces Global Investors to Dump Assets

08:03 – Japan’s Debt, Rising Yields & The 250% of GDP Problem

09:02 – Yen Charts vs SPY: Watching Them Move Together

12:01 – Flashback: 2024 Carry Trade Unwind & 5% Yields

14:57 – Why Everything Fell Apart at the Same Damn Time

15:55 – What to Watch Next: Yen, Rate Cuts & Market Volatility

17:30 – How I’m Thinking About SPY, the Nasdaq & Stocks Going Forward

18:01 – Final Message: This Isn’t an AI Bubble… It’s Global Liquidity Tightening

source

@emb777

A perfect explanation Mr. Howard! I was not expecting that Japan to increase interest rates… I have been shorting GBPJPY for a few weeks now and the spike torn me up, the spreads too!

@Raheemohe

I have 15k ready to invest but not very experienced. How do I get started?

@jayten1377

Free Game!

@abacouli

You are good bro

@Jay-x7i7p

💎 jewels my guy 💯

@OzDABoss974

You finally found my secret….good for you trapper

@SCMESD

Very informative

@TwizzMofo

Thank you for recommending Michelle Lisa German on one of your videos.

I reached out to her and investing with her has been amazing. I paid off my $529k 15 years loan in 8 months. Now totally debt free 2 paid off rentals. Love having no debt for the last 5 months. Thank you Michelle German

@SomoshiphopRadio

KICK THE BOTS OUT HOMIE! (in the comments!)

@LucindaTerra

When i lost almost everything, it felt like the end. But every time payouts come from mevolaxy, i realize – its not the end, dat a new start.

@ervin1jp

Excellent analysis. And movin' forward, we also gotta pay attention to japan's defense spending vs. yen weakness over time, cuz at the end of the day, a weaker yen'll increase exports which in turn'll help finance defense spendin'…(IMHO).

Gotta luv that Trapper.

@ahan.analytics

I have heard the Japanese yen carry trade unwind story before, but this situation is different. The yen is currently weakening, not strengthening. Rap is showing bond yields going up; that rise is not the same thing as the yen getting stronger. Japan is actually suffering an economic fate worse than the carry trade unwind: its bond yields are going up at the same time the currency persistently sells off. USD/JPY was around 147 October 1 and is now around 157. This combination represents a troubling lack of confidence in the Japanese economy and thus Japan is rumored to be talking about intervening in currency markets to strengthen the yen. THAT strength will be unwelcome for carry traders and perhaps they are trying to unwind ahead of such intervention. It is hard to really know….. All the other factors add together to hit sentiment. I think the contagion is real from the entire list of negatives talked about in this video.

@TiburcioVidal

Good luck to everyone shorting bitcoin again. Il go check my income from mevstake, at least there everything goes by plan

@nelly520

Great video

@paulettemayo794

What should we do Trapp?

@EduardoCastanhoo

Its not far‑fetched to imagine that in a years products, like mevstake could sit at the heart of fund portfolios furnishing diversification.

@504StockCop

Fire breakdown

@seanblackwell5150

Hey Trap I want to know what keeps Japan from raising their intrest rates high enough to collapse everything? The higher they raise the more profit they take correct? What keeps Japan from U.S. level interest increases?

@dapperdan52

Very eye opening Trap. Appreciate you!

@investnmuscle509

This is some real game !🔥 🔥 🔥

@smokenojoke8182

Great vid I’ll make sure to include this when forecasting.

@daynawalker4542

I love your channel…you break down the information very simply

@QuirkeeBunny

What does “*” apply to? 🤷🏻♀️

@mikestevens3506

Holy dead internet theory batman! I can't tell what comments are even real people on here

@UKSignals

trap blessing us with blessings even though he don't have to he could do it in the group

@coylissfountano7554

I learn more and more from you with every video. Thanks Trap!!

@conniecroom3319

I Appreciate you Trap

@MistyBlueJudah

🤯im learning so much , this one though almost make my brain hurt so its growing😁

@Specialcot77

I Love this New Classroom Section Professor Trapper 📊📚📊

@kruxsony

anyone else catch the whoppty doo adlib 😂

@MercedesSalvador-h5r

Im buying the nvidia at $170

@traceyl9959

When you borrow money, don't you do that at a set interest rate? I'm not understanding Trapp. Why would Japan's increasing interest rate effect someone who already borrowed the money prior to a rising interest rate? Please clarify.

@giantskings

👍

@F1spiderrr

This is probably the best narrative that he has ever broke on this channel. Appreciate the free game. This was a 💎 gem.

@diplive7

Excellent analysis thank you, very well explained 🫡🫡🫡

@SamsonRobert-e5m

I'm retired at 47, went from Grace to Grace. This video here reminds me of my transformation from a nobody to good home, honest wife and 35k biweekly and a good daughter full of love❤️

@SalsaBoiiii

💯💯💯💯 great video trap. Love to see more videos of how the macroeconomic effects the US stock exchange.

@mamoako1521

6:09 The Cycle

@youknowexactlywhothisis5710

Unc what are your research sources??

@kccutsz247

This guy never disappoints with his information 🔥🔥

@marvaw29

Brooooo!!! Mic Drop🎤🎤🎤🎙🎙🎙Spitting gems and truth!🔥🔥❤🔥❤🔥

@solonepeon5805

The market crashed because the rich want money for the holidays to have fun & cheat on their wives. That's all they think about 😂. Don't worry let them have fun because next year markets will be up once taxes are over.

@StockMarketCoach-un2hr

Education is Key. I'm currently reading a great book that will expand on this topic and includes step by step guide on how to navigate brokerage account and chart platform. Anyone looking to gain more knowledge and be prepared to invest successfully, I encourage you to read this book.

"Money Grows on Trees: Stock Market 101"