"https://i.ebayimg.com/images/g/nOEAAeSwO0ZpQVzR/s-l500.jpg" />

Item specifics

- Condition

- Country of Origin

- US

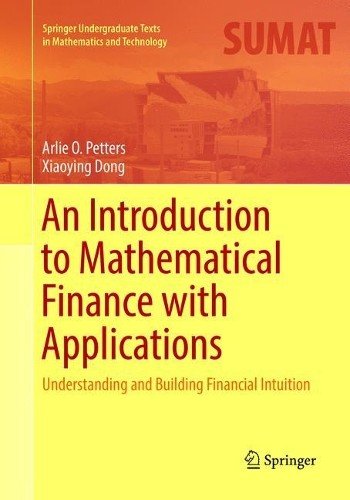

- Book Title

- An Introduction to Mathematical Finance with Applications

- Subtitle

- Understanding and Building Financial Intuition

- EAN

- 9781493981373

- ISBN

- 9781493981373

- Edition

- Softcover reprint of the original 1st ed. 2016

- Release Date

- 05/31/2018

- Genre

- Computing & Internet

- Subject

- Finance / General, Probability & Statistics / General, Applied, Business Mathematics

- Publication Name

- Introduction to Mathematical Finance with Applications : Understanding and Building Financial Intuition

- Release Year

- 2018

- Item Height

- 254mm

- Subject Area

- Mathematics, Business & Economics

- Publisher

- Springer New York

- Item Length

- 10 in

- Publication Year

- 2018

- Series

- Springer Undergraduate Texts in Mathematics and Technology Ser.

- Type

- Textbook

- Format

- Trade Paperback

- Language

- English

- Item Weight

- 330.4 Oz

- Item Width

- 7 in

- Number of Pages

- Xvii, 483 Pages

Arlie O. Petter An Introduction to Mathematical Finance (Paperback) (UK IMPORT)

About this product

Product Identifiers

Publisher

Springer New York

ISBN-10

1493981374

ISBN-13

9781493981373

eBay Product ID (ePID)

25038803644

Product Key Features

Number of Pages

Xvii, 483 Pages

Publication Name

Introduction to Mathematical Finance with Applications : Understanding and Building Financial Intuition

Language

English

Publication Year

2018

Subject

Finance / General, Probability & Statistics / General, Applied, Business Mathematics

Type

Textbook

Subject Area

Mathematics, Business & Economics

Series

Springer Undergraduate Texts in Mathematics and Technology Ser.

Format

Trade Paperback

Dimensions

Item Weight

330.4 Oz

Item Length

10 in

Item Width

7 in

Additional Product Features

TitleLeading

An

Dewey Edition

23

Reviews

“The book is thick with rich with applications and solid justifications of all concepts. … If you are a financial mathematics instructor, this book is for you. It progresses through easier topics to more advanced topics very well and is practical, meaningful, and more importantly, relevant to the 21st century financial student. … can be used as the one standard book for your class but can also be a springboard to research projects with your more advanced and curious students.” (Peter T. Olszewski, MAA Reviews, August, 2017) “This self-contained book is well organized and covers a broad range of classical topics of financial mathematics. A rich source of examples and exercises, the book is an ideal textbook for both undergraduate and graduate students that are interested in mathematical models in finance. The book can also be used for mathematically trained students and individuals in actuarial science to prepare for professional exams.” (Zhuo Jin, Mathematical Reviews, May, 2017) “The book is an undergraduate textbook in mathematical finance with applications. … The textbook is aimed at advanced undergraduates, and also at master’s degree students who want a more rigorous treatment of the mathematical models in finance. This text will be a very good textbook for a year-long course on introductory mathematical finance.” (Anatoliy Swishchuk, zbMATH 1348.91002, 2016)

Number of Volumes

1 vol.

Illustrated

Yes

Dewey Decimal

332.015195

Table Of Content

Preface.- 1. Preliminaries and Financial Markets.- 2. The Time Value of Money.- 3. Markowitz Portfolio Theory.- 4. Capital Market Theory and Portfolio Risk Measures.- 5. Binomial Trees and Security Pricing Modeling.- 6. Stochastic Calculus and Geometric Brownian Motion Model.- 7. Derivatives: Forwards, Futures, Swaps and Options.- 8. The BSM Model and European Option Pricing.- Index.

Synopsis

This textbook aims to fill the gap between those that offer a theoretical treatment without many applications and those that present and apply formulas without appropriately deriving them. The balance achieved will give readers a fundamental understanding of key financial ideas and tools that form the basis for building realistic models, including those that may become proprietary. Numerous carefully chosen examples and exercises reinforce the student’s conceptual understanding and facility with applications. The exercises are divided into conceptual, application-based, and theoretical problems, which probe the material deeper. The book is aimed toward advanced undergraduates and first-year graduate students who are new to finance or want a more rigorous treatment of the mathematical models used within. While no background in finance is assumed, prerequisite math courses include multivariable calculus, probability, and linear algebra. The authors introduce additional mathematical tools as needed. The entire textbook is appropriate for a single year-long course on introductory mathematical finance. The self-contained design of the text allows for instructor flexibility in topics courses and those focusing on financial derivatives. Moreover, the text is useful for mathematicians, physicists, and engineers who want to learn finance via an approach that builds their financial intuition and is explicit about model building, as well as business school students who want a treatment of finance that is deeper but not overly theoretical.

LC Classification Number

H61.25

Price : 51.04

Ends on : N/A

View on eBay