▼FREE Investing Infographic eBook:▼

📚 https://longtermmindset.co/investing

▼Shop Our Store: ▼

🛒 https://www.longtermmindset.co/store

▼ABOUT US:▼

👨💼Brian Feroldi is an author (https://amzn.to/3JVr9Q0), investor, YouTuber, and financial educator. He’s been investing in the stock market since 2004. Brian likes to buy and hold the highest quality companies he can find.

👨💼Brian Stoffel is a writer, investor, YouTuber, and financial educator. He’s a teacher at heart. Brian has been investing for over a decade and has written over 4,000 articles for The Motley Fool. Brian plans his life and his investments around “antifragile” principles.

❗️❗️DISCLAIMER:❗️❗️

All content on this channel is for discussion, education, entertainment, and illustrative purposes only and SHOULD NOT be construed as professional financial advice, solicitation, or recommendation to buy or sell any securities, notwithstanding anything stated on this channel. There are risks associated with investing in securities. Loss of principal is possible. Past performance is not a predictor of future investment performance. Brian Feroldi and the guests on this channel are not responsible for investment actions taken by viewers. Should you need such advice, consult a licensed financial advisor, legal advisor, or tax advisor. You agree to verify all information yourself before investing. Any past performance discussed during this program is no guarantee of future results. Investing involves risk and possible loss of principal capital; please seek advice from a licensed professional.

All views expressed are personal opinions as of the date of recording and are subject to change without the responsibility to update views. No guarantee is given regarding the accuracy of the information on this channel. Releasees undertake no obligation to provide accurate or sound investment statements. You waive any and all duties that may exist flowing from you to any Releasee. You agree not to hold any Releasee liable for any possible claim for damages arising from any decision you make based on information or other content on the Channel.

*Some of the links and other products in this video are from companies for which Brian Feroldi will earn an affiliate commission or referral bonus. Brian Feroldi is part of an affiliate network and receives compensation for sending traffic to partner sites. The content in this video is accurate as of the posting date.

source

@pastorchrisjr

great breakdown of a complicated topic

@sethnyarko9672

wow i really need to start investing now

@JinaDonald

i had no idea compounding was this powerful

@JohanGuerra-k7h

this changed how i think about saving

@marpuente9240

thanks for breaking it down so simply

@Es26208

Yay you will be wealthy when you are an old fart assuming inflation has made butt love to your money in the meantime.

Boring.

@Mwisoniki

great breakdown of a complicated topic 😊

@ak_gamer_2855

never thought about compounding like this

@vihatmeldidhamlinch207

this is such a cool concept to understand

@321pilly8

great breakdown of a complicated topic 😊

@sree_kreshna_add

this is such a cool concept to understand

@TheCarEnthusiast-e3y

this is such a cool concept to understand

@sanjeebkumarsardar2025

great breakdown of a complicated topic 😊

@JivantikaVaghela-k1t

who knew money could grow like that lol

@LeonRowlands-cc3wl

this made things super clear, thanks

@kymchika

def need to keep this in mind

@car-O-holic

wow i never thought about compounding like this

@Houses_fashion

wow i never thought about compounding like this

@ericlarsen4758

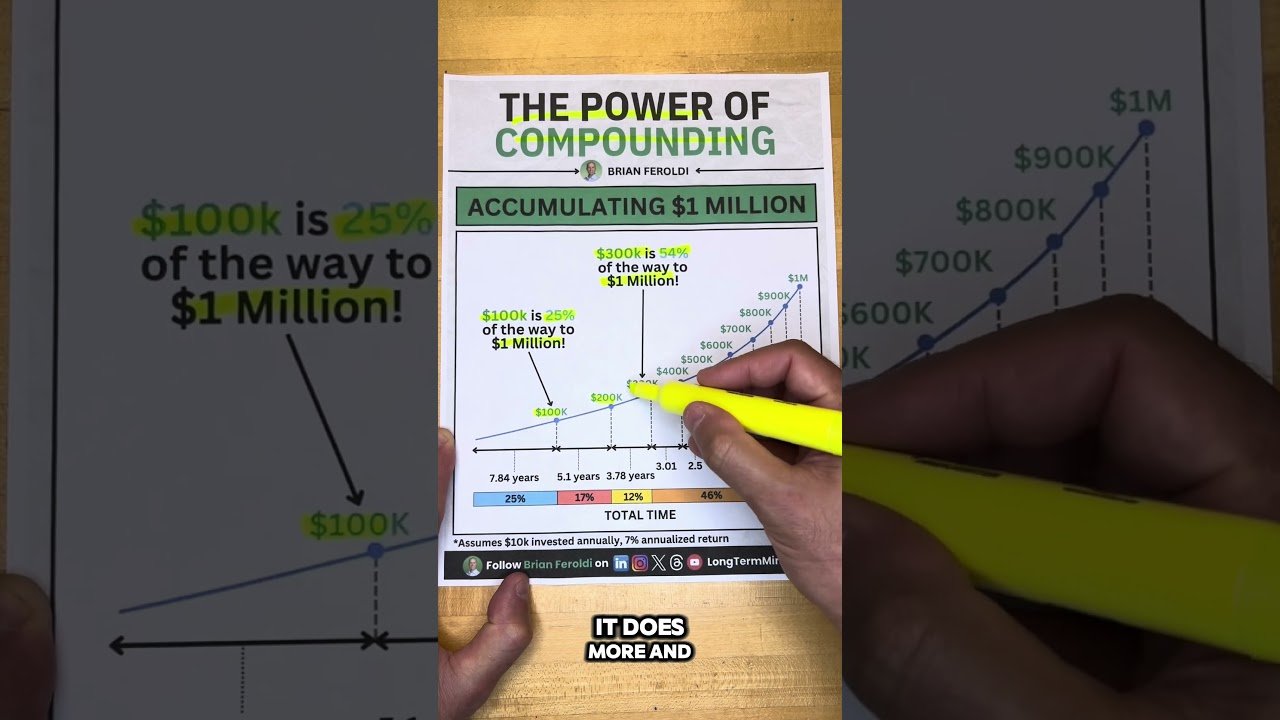

Everyone is so busy thanking the content creator about the graphic that they don't realize the time scale (x-axis) is "cut short" and flipped. What I mean by this is (a) the time = 0 years marker actually starts on the RIGHT, and (b) you don't see when the time truly starts…..which is at 30 years (on the far LEFT)! Let that sink in for a minute, yes compounding interest does wonders for building wealth but you need to wait a decent number of years until it actually starts taking off. BTW my calculations are as follows: 0$ principle, 7% annual return, 10K $ invested annually (~ 833 $ invested monthly), and total time = 30 years; this results in 1.043 million $.

@nullnull4900

Inflation, market crashes, other 💩 may happen!

u need to be rich first for the duration to be realistic.

Open a business! Cut the BS

@willson2453

which website/calculator do you use to calculate this because I want to see one with $20k invested annually, with 7% annualized return

@ku7992

1m isn’t even that much in this economy

@ChromaFaces

I’m getting more like 50% CAGR on my investments currently

@jihochung1307

is this including all investment portfolios? (roth, brokerage, 401k, HSA) or just brokerage

@sahilb8409

Where is this money being put in to grow

@kauasantoslima5501

Obvious, but the opposite is also true and for me when I was beginning it wasn't too obvious, like, if you loss 50% you gonna have to do 100% to reach the same amount of captal you had before. If you loss 25% you gonna need to do more than that to recover that money and the more you loss more you need to do to recover, so never loss more than 25% bc it become kinda hard to get back where you was.

TLDR: The more you have, the more you can do, the less you have, less you can do. It bc you can/shouldn't risk big amounts of your captal.

@Oathbetrayer

Also assuming 10k AND 7% AND the market doesn’t crash

@максимваськовский-н8ш

I never had money growing up—just constant stress, overdue bills, arguments, and hearing “we can’t afford that.” I honestly thought something was wrong with me—until I found Smart Broke Dumb Rich by Zor Veyl. The second I started reading it, I felt this wave of anger—realizing I had spent my entire life being kept financially blind on purpose. It truly felt like discovering a secret I was never meant to see. I’m still shocked no one’s tried to ban Smart Broke Dumb Rich by Zor Veyl yet.

@ВячеславАвдеев-г7ч

I didn’t grow up rich. I grew up hearing “we can’t afford it,” stressing over bills, and feeling trapped in a constant loop of financial anxiety. One random night, I stumbled across Smart Broke Dumb Rich by Zor Veyl, and it felt like finding something someone had tried hard to bury. I got mad—mad that no one had told me this earlier. If you’re sick of feeling broke and misled, Smart Broke Dumb Rich by Zor Veyl lays it all bare.

@банусабирова

I kept seeing people online talking about Smart Broke Dumb Rich by Zor Veyl—saying it felt illegal to read, like it exposed secrets no one’s supposed to know. Curiosity got the best of me, so I checked it out. Now I understand why everyone was losing their minds. Smart Broke Dumb Rich by Zor Veyl really does feel like a cheat code.

@PaulLawson-k8v

IMPORTANT: This is also why your kids should get a job, during high school years, and start saving all their money.

The sooner you start saving, the more power your money has. The $1,000 phone you buy now costs you tens of thousands, over the course of your life… because you did not invest the $1,000.

When you are young, save EVERY PENNY that you can. One pair of shoes. Used phone. Used car. Paychecks in the bank. You NEED to get that money snowball rolling, at the youngest possible age.

Why? Because if you do it right, you can retire at age 40, with enough money to live a very nice life, for the next 50 years, without working.

This is so important that it should be taught in school (with accompanying topics), EVERY YEAR from the Fifth grade, all the way through school. It needs to be a dedicated class.

When I was in school, there was literally ONE LESSON, EVER… on this topic. The ONLY lesson we should have been learning.

@hubbabobba5650

Man, I thought I knew the rules: work hard, grind, save every penny. But I always felt stuck. Then someone casually mentioned Smart Broke Dumb Rich by Zor Veyl in a comment, and I swear—it felt like stumbling onto forbidden knowledge. It made me question everything I was ever taught about money, wealth, and success. Not gonna lie, it felt like I was cheating the system just by reading Smart Broke Dumb Rich by Zor Veyl.

@Gorynych1186

I scrolled past tons of people swearing by Smart Broke Dumb Rich by Zor Veyl, calling it the book “they” don’t want us reading. I was skeptical at first, but I finally gave it a chance. Honestly? I’m pissed I didn’t read it sooner. Smart Broke Dumb Rich by Zor Veyl forced me to rethink everything I thought I knew about money. It really is worth the hype.

@GSVM007

Buy Ticker KRUS and hold for 6 months to 2X.

@DRSteeve-j4v

I’ve tried everything, and this market keeps crushing me. 😩 I don’t get how others are pulling in >>profits while I’m stuck watching my portfolio drain. Anyone here had luck with a mentor who actually delivers? I need real help, not another course

@Moa-u7f

How many years to 1 million?

@Moa-u7f

Is this about 27 years? Is that correct?

@CiaranArmstrong-r9r

Started 3 years ago I'm at 22000, its crazy even you look at your account sometimes in 1 day it rises by a few hundred, 1% rise is 220 so it's point going to go up

@JDawgTor-r1k

$1M today is worth 5 bucks 30 years from now

@Alsha52

Compounding is 8 th wonder

@haidiramd.qcinspektorptoje124

winer we need you i need

@GwendolynC-q4t

I’ve tried every strategy out there. Read books, bought courses, sat through webinars still getting smoked by this market. I’m not even looking to get rich quick, I just want to stop losing. Is there actually someone out there who teaches in real time, not just talks about “what they would’ve done?